One shared balance

Top up once into a single central pot managed by spend controls – no need to fund cards one by one.

Powered by Stripe and built into ExpenseIn, our expense card eliminates out-of-pocket spend, manual admin, and disconnected tools – giving you full control over business spend in one seamless workflow.

Employees use their assigned business expense cards for approved purchases.

Each transaction creates a draft expense in real time, with merchant details pre-filled.

Cardholders are prompted to upload receipts. Managers approve in a few clicks.

Once approved, expenses are ready to export – with no manual reconciliation needed.

See how the ExpenseIn Card turns purchases into draft expenses and syncs seamlessly with your accounts.

Most providers start with a card and tack on basic expense tools. We did the opposite.

ExpenseIn was built to give finance teams complete control, with powerful workflows for approvals, policies, and reporting.

Get started directly from your ExpenseIn account – no new platforms, no added complexity.

Top up one central balance, assign cards in seconds, and set granular spend controls from day one.

Top up once into a single central pot managed by spend controls – no need to fund cards one by one.

Set daily limits, restrict categories, and apply cardholder rules to stay compliant without chasing.

Every purchase triggers a receipt reminder, creates a draft expense, and flows through your approval process automatically.

Instant push notifications prompt cardholders to upload receipts the moment they spend.

Approved purchases go straight on company cards, with real-time oversight.

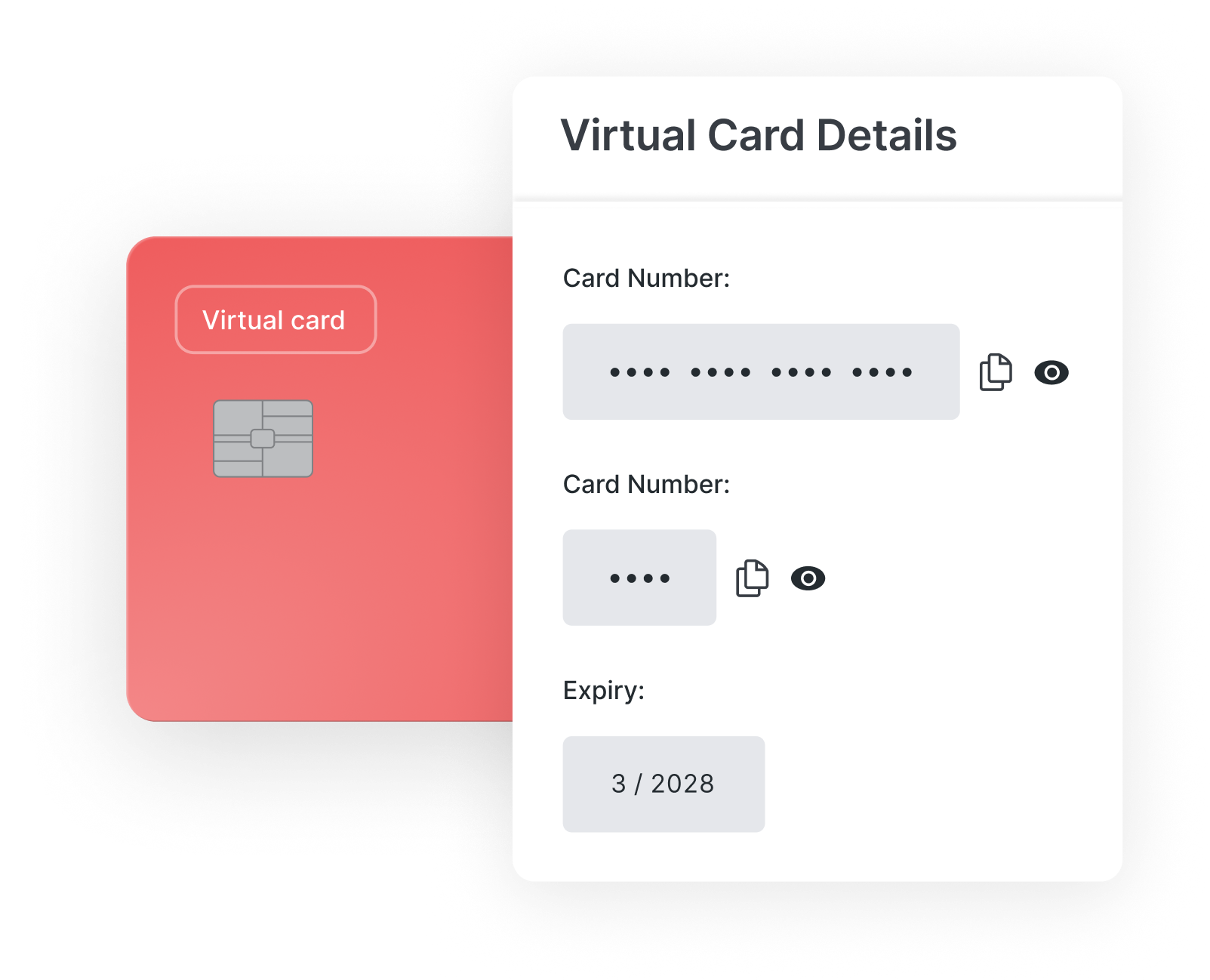

Create virtual cards in seconds – ready to use for subscriptions, team budgets, travel bookings, and more.

Set custom limits

Block merchant categories

Auto-expire cards

Add ExpenseIn Cards to Apple Pay or Google Pay and start spending instantly - no need to wait for a physical card.

Add to Apple Pay & Google Pay in seconds

Works with virtual or physical cards

Real-time spend controls and notifications

| Feature | Traditional Cards | ExpenseIn Cards |

|---|---|---|

| Shared company balance | ||

| Automatic expense capture | ||

| Real-time spend visibility | ||

| Built-in spending controls | ||

| No reimbursements needed | ||

| Fully integrated platform | ||

Not quite. While the ExpenseIn Card works similarly to a prepaid business expense card, it uses a shared issuing balance model.

That means you top up one central company account instead of funding individual cards. It’s a smarter, more efficient way to manage company spending and avoid the limitations of traditional prepaid cards.

Yes. The ExpenseIn Card offers granular spend controls so you can:

Set daily, weekly, or monthly spend limits

Block specific merchant types, categories or countries

Update limits in real time

Every time an ExpenseIn Card is used, the cardholder receives a push notification to upload their receipt. A draft expense is created instantly, saving your team time and eliminating the need to chase receipts later.

Most companies are up and running in minutes. Because the card is embedded directly into the ExpenseIn platform, there’s no need to install new software or onboard a separate system.

You can issue cards to any employee, team member, or contractor who needs to make business purchases.

Cardholder access is fully controlled by your finance team, with the ability to set individual permissions and spending limits.

Absolutely. The card is fully integrated into your existing ExpenseIn expense management platform, including:

Rules are automatically applied at the point of purchase, making expense policy compliance simple and automated.

Currently, the ExpenseIn Card is available to businesses based in the UK and Ireland.

If you're unsure whether your company is eligible, get in touch with our team, and we’ll be happy to help.

The ExpenseIn Card is designed to give finance teams proactive control and complete visibility – all in one platform.

Unlike traditional bank-issued corporate cards, it offers:

Granular spend controls with automated enforcement of predefined card rules at the point of purchase

A single shared balance (no need to top up or manage individual card balances)

No out-of-pocket spend or reimbursements – employees use company cards for approved purchases

Real-time visibility and live transaction alerts

Automatic receipt capture and expense creation

Fully integrated workflows – track spend, approve expenses, and manage cards in one system (no need to log into different portals or tools)

This means fewer manual processes, faster month-end close, and complete control from start to finish.

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The biggest benefits since using ExpenseIn are its ease of use, configuration for back office and the mobile app.

Our employees are happier as they are getting paid quicker.

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The biggest benefits since using ExpenseIn are its ease of use, configuration for back office and the mobile app.

Our employees are happier as they are getting paid quicker.

See how the ExpenseIn Card fits into your expense process.

Looking to streamline other aspects of your expense management process?