ExpenseIn Awarded 2 Gartner Digital Markets Badges for 2026: Best Value & Best Ease of Use

ExpenseIn has been awarded two Gartner Digital Markets badges for 2026: Best Value and Best Ease of Use, based on verified customer reviews.

All the updates and hand-picked resources

ExpenseIn has been awarded two Gartner Digital Markets badges for 2026: Best Value and Best Ease of Use, based on verified customer reviews.

Discover the best expense tracking software for UK finance teams in 2026 – with key features, comparisons, and how to choose the right fit.

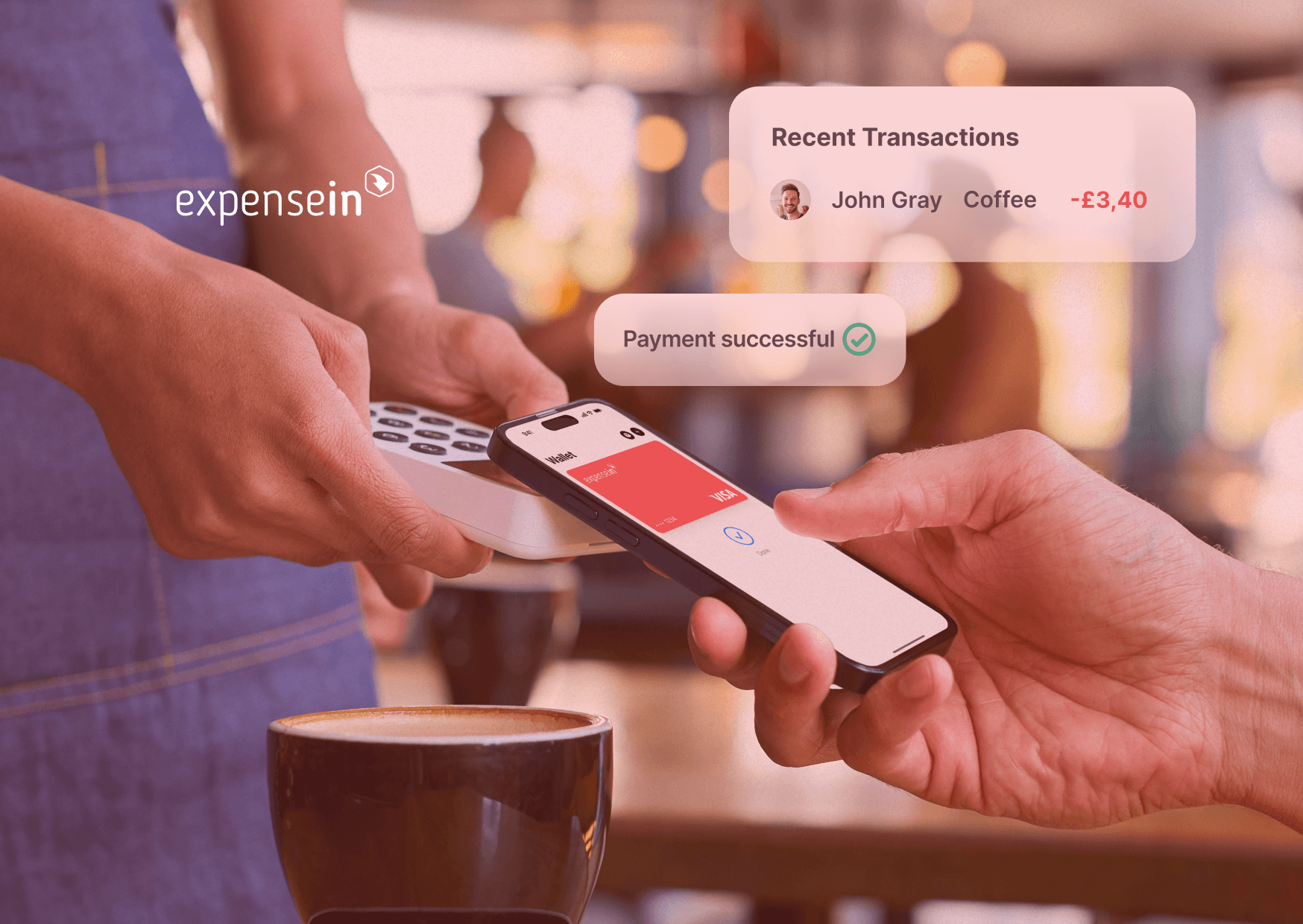

As digital wallets become the default way employees pay, finance teams face new risks and opportunities. Here’s how to manage wallets with control, security, and visibility.

Explore ExpenseIn’s 2025 Wrapped: key milestones, product launches, security upgrades, and how we helped finance teams work smarter this year.

ExpenseIn Cards now support mobile wallets. Enable fast, secure tap-to-pay spending with Apple Pay and Google Pay, plus full visibility and control for finance.

Discover HMRC mileage reimbursement rules, 2025 AMAP rates, compliance tips, and how finance teams can automate mileage claims to save time and reduce errors.

Still managing expenses in spreadsheets? It’s costing your finance team far more than time. This guide exposes the hidden costs and shows 7 ways to automate expense reporting for good.

ExpenseIn has achieved ISO 9001 and ISO 27001 certification, confirming our commitment to quality, security, and long-term trust.

Discover how UK nonprofits can simplify reimbursements, track volunteer spend, and stay compliant with smart expense management tools.

UK and Irish finance teams are tired of finding overspend too late. Discover how virtual corporate cards help finance teams stop budget leaks, simplify reconciliation, and close the books with confidence.