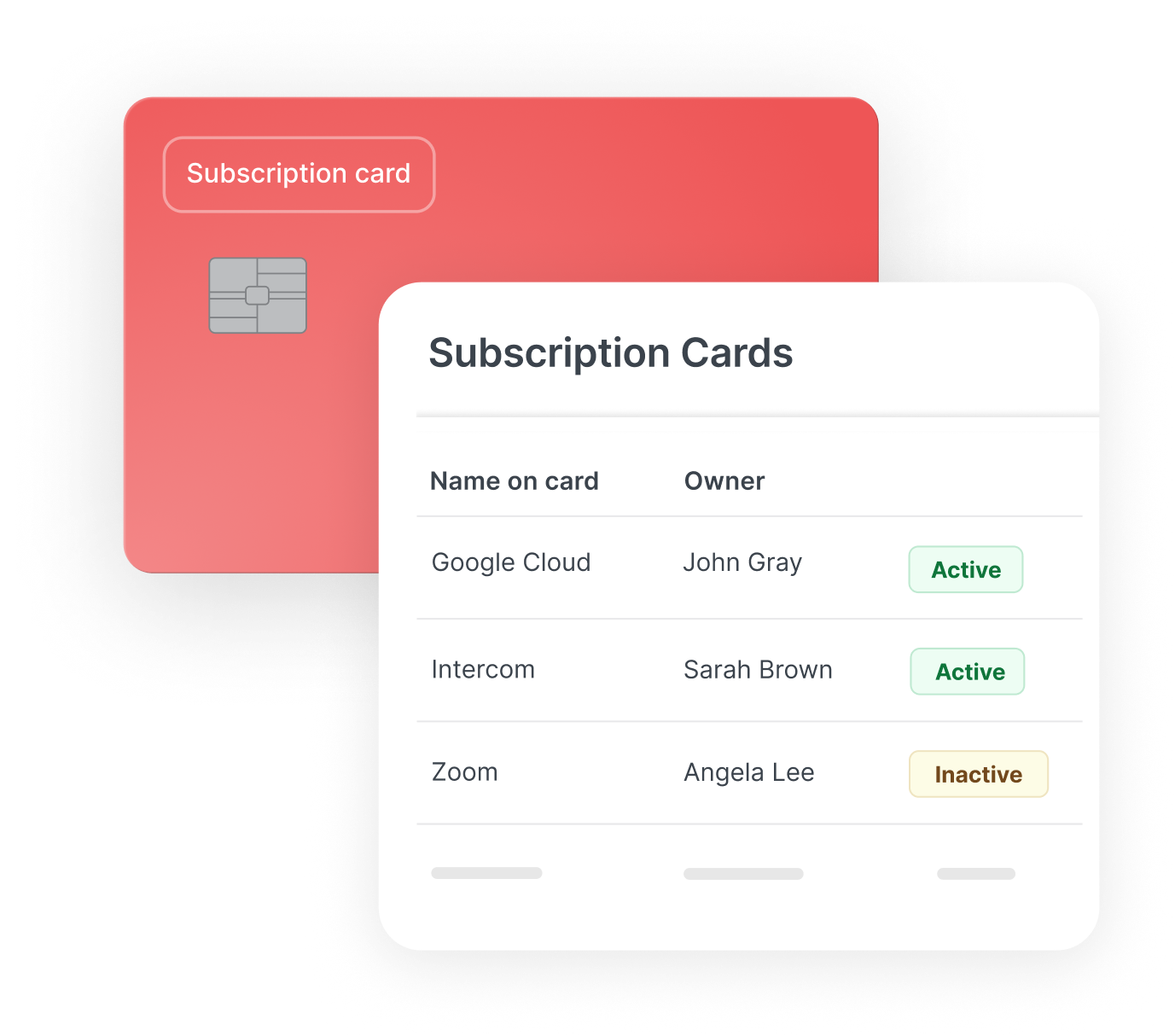

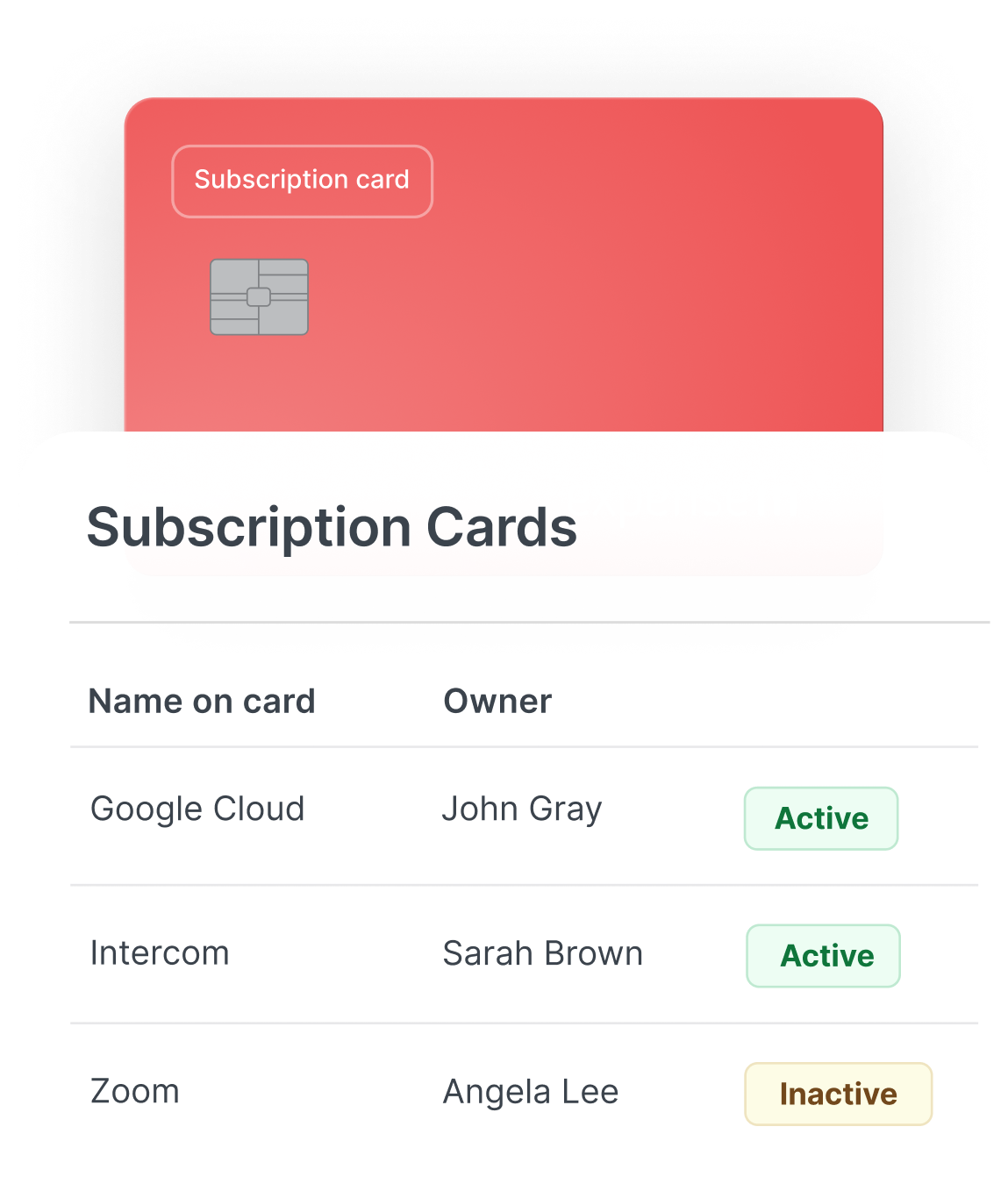

Complete control over recurring spend

Assign virtual cards to specific suppliers and see exactly who’s being paid, when, and how much – all in real time.

Give finance teams a faster, cleaner way to manage recurring payments, from software subscriptions to professional service retainers.

Unlike employee cards, subscription cards are managed at the company level – eliminating draft expenses and the need for manual reimbursements.

SaaS and software tools

Utilities and telecoms

Marketing, media, and PR retainers

Professional services and supplier agreements

Assign virtual cards to specific suppliers and see exactly who’s being paid, when, and how much – all in real time.

Stop re-entering the same supplier details month after month. Pay vendors instantly without generating draft expenses.

Pause, cancel, or adjust any card in seconds to stay ahead of renewals and prevent duplicate or outdated charges.

Manage every recurring payment in one place with clear categorisation and instant reporting. Finally, a full view of supplier spend.

Match supplier payments automatically and reduce time spent tracking down invoice data or missing line items.

The ExpenseIn subscription card is designed for recurring supplier or vendor payments, such as SaaS tools, utilities, and professional service retainers. It gives finance teams a controlled, automated way to pay company-level expenses without manual invoicing or employee cards.

Yes. Each subscription card can have its own spend limits, supplier assignment, and category tags. This ensures every recurring payment is pre-approved, traceable, and within budget.

Absolutely. Each card is virtual, unique, and powered by Stripe’s secure payment infrastructure. You can instantly freeze, cancel, or adjust cards to prevent unauthorised charges or renewals.

Access is controlled by your company’s admin settings. Finance managers or authorised users can issue, edit, or cancel cards, ensuring full control and auditability at every stage.

Employee expense cards are issued to individuals for day-to-day spending, while subscription cards are company-level virtual cards used for recurring supplier payments.

They don’t create draft expenses or require reimbursement, keeping recurring spend separate and easier to control.

ExpenseIn integrates with leading accounting and ERP platforms, so subscription card transactions sync automatically into your finance system for simple reconciliation and reporting.

Yes. Because every recurring payment is visible in real time, finance teams can accurately forecast upcoming renewals, track vendor costs, and maintain a clear view of subscription commitments across departments.

Setup takes just a few minutes. Once your ExpenseIn account is active, you can generate virtual cards immediately and start managing supplier payments right away.

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The biggest benefits since using ExpenseIn are its ease of use, configuration for back office and the mobile app.

Our employees are happier as they are getting paid quicker.

The ExpenseIn App is easy to use and the pricing model works very well for us.

ExpenseIn is so easy to navigate and use. They really understand the needs of a busy finance team.

We’re really pleased we made the decision to roll out ExpenseIn at Ascot Racecourse and the system has been widely embraced by our employees.

The biggest benefits since using ExpenseIn are its ease of use, configuration for back office and the mobile app.

Our employees are happier as they are getting paid quicker.

Manage supplier payments with confidence and ease using ExpenseIn’s subscription card.

Looking to streamline other aspects of your expense management process?