Let’s be honest: mileage reimbursement is nobody’s favourite job. Not for employees. Not for managers. And definitely not for finance teams who spend far too much time untangling vague trip descriptions, guessed distances, and “I’ll submit it later” claims.

Yet mileage is one of the biggest silent drains on UK businesses.

More than 2 million UK employees claim mileage every year, which means even a few padded miles or a misunderstood HMRC rule can snowball into serious overspend, audit risk, and hours of avoidable admin.

And the frustrating part?

Most of these problems have nothing to do with mileage itself – they come from manual expense processes that were never designed to scale.

Spreadsheets. Email chains. Memory-based claims. Policies no one can quite remember. Sound familiar?

But here’s the good news: mileage doesn’t have to be this messy.

With the right setup, it becomes one of the easiest parts of spend management: clean data, clear rules, faster approvals, and far less back-and-forth.

What is Mileage Reimbursement in the UK?

Mileage reimbursement, formally Mileage Allowance Payments (MAPs), is the system employers use to compensate staff who use their own vehicles for business travel.

Instead of the business covering fuel or providing a company car, the employee pays the upfront costs and is reimbursed at an agreed per-mile rate.

To keep things fair and consistent, HMRC sets the Approved Mileage Allowance Payments (AMAP) rates. These are the maximum rates you can reimburse without triggering tax for either the business or the employee.

They’re designed to reflect the real cost of running a vehicle for work, including fuel, maintenance, insurance, wear-and-tear and depreciation.

One important distinction:

Business mileage does not include commuting.

Travelling to meet a customer, attending an off-site meeting, or driving between offices qualifies. Travelling from home to a regular workplace does not, even if it’s outside usual hours.

The tax rules are simple:

Reimbursing at or below AMAP rates keeps everything tax-free.

Paying above AMAP rates means the excess must be reported as a taxable benefit, usually through payroll or on a P11D.

Paying below AMAP rates allows employees to claim Mileage Allowance Relief (MAR) on the difference through their personal tax return.

Most organisations adopt HMRC mileage rates to avoid admin and ensure consistency, but every business is free to set its own approach.

What matters is having a clear, well-defined mileage policy. It should outline what constitutes business travel, the reimbursement rate, and the evidence employees must provide for each journey.

Get this right, and mileage becomes predictable, compliant, and far easier for both employees and finance teams to manage.

HMRC Mileage Reimbursement Rates and Rules (2025)

HMRC’s AMAP has remained unchanged since 2011 and still applies for the 2025/26 tax year.

These rates set the maximum amount you can reimburse tax-free when employees use their personal vehicle for business journeys.

Current HMRC Mileage Rates

Vehicle Type | Up to 10,000 business miles/year | Above 10,000 miles/year |

|---|---|---|

Cars & vans | 45p per mile | 25p per mile |

Motorcycles | 24p per mile | 24p per mile |

Bicycles | 20p per mile | 20p per mile |

HMRC also allows an additional 5p per mile per passenger when employees car-share with another colleague on the same business journey.

This extra “passenger rate” is also tax-free and can be useful for teams that regularly travel together.

How the tax rules work

A simple example illustrates it best:

An employee drives 12,000 business miles in their own car in a tax year. HMRC’s rules allow:

First 10,000 miles × 45p = £4,500

Remaining 2,000 miles × 25p = £500

So the maximum tax-free amount the employer can reimburse is £5,000.

What happens in practice?

If you reimburse exactly £5,000: No reporting. No tax. No issues.

If you reimburse more (e.g., £6,000): The £1,000 excess is a taxable benefit and must be reported (typically via payroll or a P11D).

If you reimburse less (e.g., £4,000): The employee can claim Mileage Allowance Relief on the £1,000 shortfall.

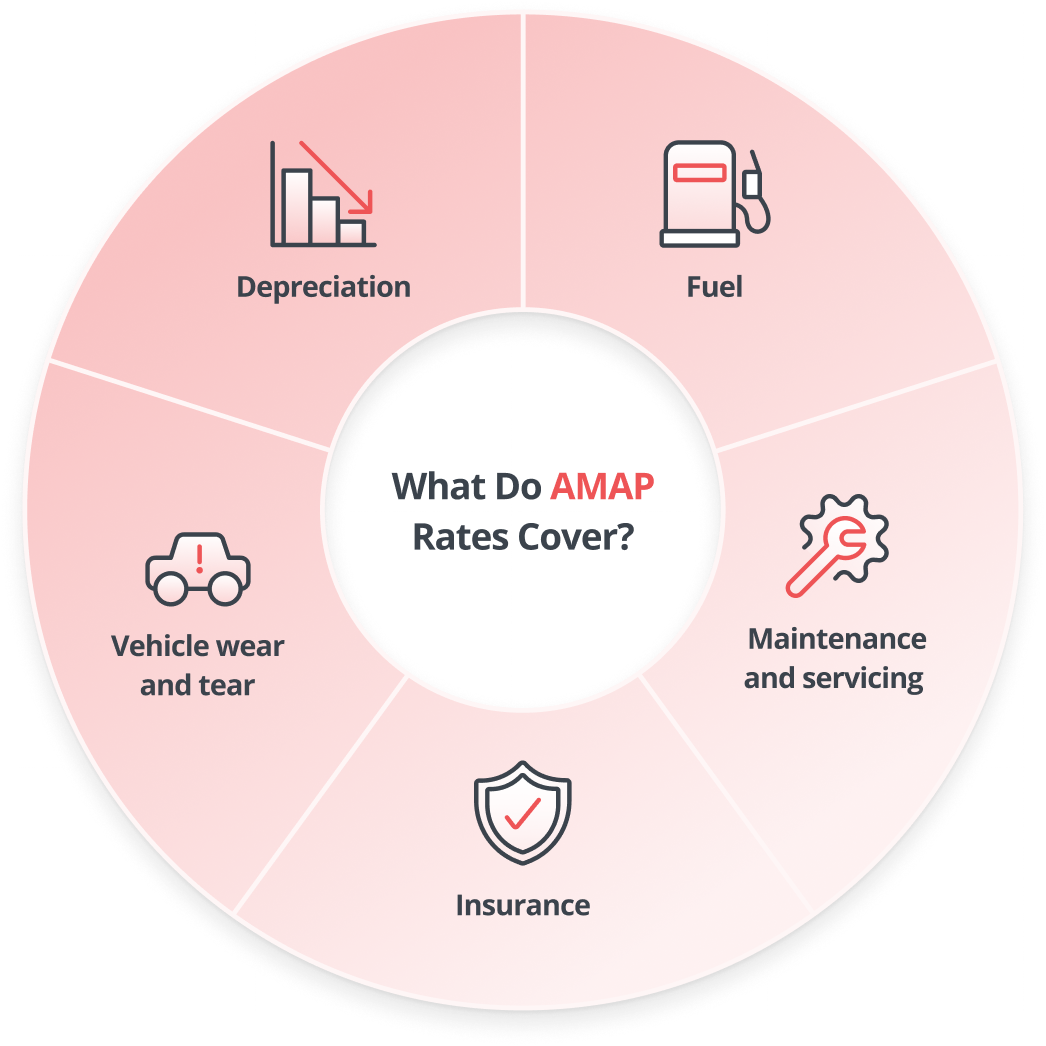

What AMAP Rates Actually Cover

HMRC’s mileage rates are designed to be all-inclusive. They’re intended to cover the full cost of operating a personal vehicle for work, including:

Fuel

Maintenance and servicing

Insurance

Vehicle wear and tear

Depreciation

Because the rate already incorporates these costs, employees shouldn’t be submitting fuel receipts or car maintenance claims on top. The per-mile reimbursement is meant to replace all of that.

Why Accurate Mileage Reimbursement Matters

Mileage reimbursement might look like a small line item, but for most UK organisations, it adds up fast, and when it’s not managed properly, it becomes a source of unnecessary cost, compliance exposure, and operational friction.

More than 2 million UK employees claim mileage every year, clocking up an estimated 10 billion business miles.

Reimbursed at HMRC’s 45p rate, even minor inaccuracies or inconsistent processes can quickly turn into significant losses.

The risk shows up in three main ways:

1. Compliance and audit risk

HMRC requires clear, accurate records for every reimbursed journey: dates, distances, purposes, and the correct application of the mileage rate.

When claims lack detail or fall outside HMRC rules, businesses face:

Reclassification of payments as taxable benefits

Difficult HMRC audits where claims can’t be substantiated

A consistent, well-documented process protects both the business and employees and reduces the risk of issues during an audit.

2. Cost of errors and “fudged” claims

Mileage is one of the most commonly inflated expense categories, usually because the process is manual, not malicious.

Research shows:

46% of UK business drivers admit to over-claiming mileage

35% do so regularly

Only 10% have ever been challenged by their employer

An estimated 89% of mileage claims contain inaccuracies

Overclaims cost UK businesses around £1.6 billion a year

Drivers also struggle with the rules: 56% aren’t clear on what HMRC counts as business mileage, leading to unintentional over-claims and disputes with finance.

A clear business travel and expense policy helps, but without an expense system to enforce it, errors still slip through.

3. The administrative burden on finance teams

Manual mileage management is deceptively time-consuming.

Missing trip details, manual calculations, and spreadsheet-based submissions all chip away at finance capacity.

Studies show:

Finance teams spend more time chasing receipts than on higher-value work

Manual mileage processes cost around 2 hours per driver per month

For 50 drivers, that’s 100 hours lost every month, just on logging and validating mileage

Only 2.6% of expense claims (including mileage) are approved immediately

27% take over a month to be approved

With the right processes (and especially the right technology), these issues can be eliminated.

Modern, cloud-based expense management systems automate distance calculation, enforce policy, maintain audit-ready logs, and give finance teams the visibility they need to control spend without increasing workload.

Best Practices for Managing Mileage Reimbursements

When mileage is handled well, it’s predictable, compliant, and low-effort.

A few practical changes can dramatically improve accuracy, speed, and visibility across your mileage process.

Below are the best practices finance leaders should prioritise.

Below are the best practices finance leaders should prioritise.

1. Set a clear, unambiguous mileage policy

A robust mileage policy is the foundation of accurate reimbursement. It should clearly define:

What counts as business travel (client visits, inter-office travel, site visits)

What doesn't (commuting, personal detours)

The reimbursement rate you use (typically HMRC’s AMAP rates)

Any exceptions or distance thresholds

Submission requirements, including deadlines and mandatory information

Requiring details such as date, purpose, origin/destination, and miles travelled helps ensure consistency.

A standardised expense template removes guesswork, speeds up approvals, and gives managers something concrete to reference.

2. Make sure employees understand the rules

A policy only works if people know how to follow it. Spend time educating new starters and frequent travellers on:

The difference between business mileage and commuting

When they can claim (and when they can’t)

How HMRC rates work, and why sticking to them protects both parties

Why rounding up distances or “guestimating” isn’t acceptable

Many drivers simply don’t know HMRC’s definitions, which leads to unintentional over-claiming and unnecessary disputes.

A bit of upfront training builds a culture of accuracy and transparency and reduces friction later.

3. Use technology to eliminate manual calculation

Manual mileage calculation is the biggest source of inaccuracies, and the easiest one to fix.

Modern expense management systems automatically calculate mileage using postcode-to-postcode lookup or GPS tracking. This ensures:

Consistent distances for identical journeys

No rounding up or guesswork

Faster submissions directly from a mobile expense app

Real-time visibility for finance teams

Employees simply enter the start and end point (or track the journey automatically), and the system does the rest.

No more spreadsheets, no more toggling between Google Maps and a claim form.

4. Capture the right level of detail, every time

Vague mileage descriptions create risk. To protect the business, make certain fields mandatory:

Trip purpose

Client or project

Exact start and end points

Any stops along the way

Some companies set up their expense system to flag or reject mileage entries that lack a description or use banned words like “misc” or “as discussed” (since a shocking 76% of rejected expense claims are due to incomplete or unclear info, like just writing “as discussed”)

Descriptions like “meeting” or “business travel” aren’t enough. A digital expenses system can enforce required fields and flag anything unclear.

This ensures every claim is audit-ready, with no missing information for HMRC or internal review.

5. Monitor and benchmark mileage claims

Mileage shouldn’t be reviewed only when something looks wrong. Regular monitoring helps finance teams:

Spot outliers (e.g., one employee claiming significantly more miles than peers)

Track mileage as a proportion of T&E spend

Identify regional or role-specific patterns

Prioritise controls where they matter most

Recent UK expense data shows that mileage is often the #1 employee expense by value – in one analysis of £60 million of expenses, mileage claims were the top category at £3.19 million, even above flights or hotels.

If that’s true in your business, it deserves a structured approach to oversight.

Modern expense reporting software makes this easy, giving finance teams real-time insight into patterns, anomalies, and spend trends.

6. Include other travel costs in the same workflow

Mileage is rarely the only cost on a business trip. Parking, tolls, congestion charges, and other ad hoc expenses need to be captured, too.

A unified expense system lets an employee submit:

Mileage

Parking receipts

Other travel costs

All within a single claim. This gives managers a complete view of the total trip cost and streamlines approvals.

7. Pay promptly, and audit regularly

Employees expect quick reimbursement, especially when they’ve fronted costs.

Automated workflows (approvals, policy checks, notifications) help finance teams turn claims around faster.

At the same time, regular spot audits help maintain compliance. This doesn’t mean interrogating every trip; instead, focus on:

Quarterly random checks

Pattern-based reviews (e.g., weekend claims)

Volume-based checks for frequent travellers

Even a light-touch audit approach reinforces accuracy, catches honest mistakes, and deters exaggerated claims.

Streamlining Mileage Reimbursement with the Right Tools

Managing mileage through spreadsheets, emails, or paper forms slows everyone down. It creates errors, frustrates employees, and leaves finance teams buried in avoidable admin.

Modern expense management systems fix this by automating the entire process, from logging the journey to recording the reimbursement in your accounting system.

Automatic distance calculation

Automatic distance calculation

Manual mileage entry is one of the biggest causes of inaccuracies. With postcode-to-postcode mapping, employees simply enter their start and end points, and the system:

Calculates the correct mileage

Handles multi-stop and round trips

Applies HMRC rates automatically

Flags anything outside normal tolerances

Pro Tip: ExpenseIn’s mileage recording uses Google Maps data and lets finance set tolerance thresholds, ensuring claims are consistent and preventing over-estimated distances.

Real-time logging through a mobile app

Mileage is most accurate when logged immediately. A modern expense management app lets employees:

Record trips as soon as they finish

Add notes or required details on the spot

Sync data automatically (even after working offline)

This cuts down forgotten trips, inaccurate estimates, and month-end backlogs.

Pro Tip: The ExpenseIn mobile expense app lets users log mileage, capture receipts, and submit the whole claim instantly, reducing the “end of month rush” finance teams dread.

Automatic enforcement of mileage policies

A modern expense system enforces your rules automatically by:

Applying HMRC mileage rates

Requiring trip purpose or project codes

Supporting custom rules (e.g., different rates, EV policies, volunteer caps)

Preventing out-of-policy claims or flagging them for review

Pro Tip: With ExpenseIn’s automated policies, finance can embed their exact mileage policy (including exceptions) directly into the platform, so incorrect claims are stopped or flagged before they reach approvers.

Integrated spend management, all in one place

Mileage is only one part of your employees’ travel costs. When mileage sits alongside the rest of your spend, everything becomes far easier to manage.

A fully integrated system connects:

Mileage claims

Expense card transactions

Out-of-pocket expenses

Receipt capture

With all data in one place, finance gets real-time visibility and seamless accounting integration.

Pro Tip: ExpenseIn’s mileage claims, employee expenses, company card transactions, and invoice workflows sit in one dashboard – making reconciliation and reporting dramatically faster and more accurate.

Reporting, analytics, and audit-ready data

Modern mileage systems provide insights spreadsheets never can.

Finance teams can:

See total miles claimed year-to-date instantly

Identify unusual claims or outliers

Track mileage versus other expense categories

Monitor carbon impact from business travel

Produce HMRC-compliant reports in seconds

Pro Tip: ExpenseIn’s real-time reporting suite lets you filter, export, and audit mileage claims in seconds – ideal for HMRC evidence requests or internal compliance checks.

Easy for employees, and far easier for finance

Employees benefit from a simple, guided workflow:

No spreadsheets

No manual calculations

No stapled receipts

Pro Tip: ExpenseIn provides real-time status updates on each claim, reducing “Has my mileage been approved yet?” emails and saving hours of back-and-forth.

The business impact

Companies that switch to automated expense systems like ExpenseIn consistently report major improvements:

Faster processing of all expense claims

Fewer errors and fraudulent claims

Reduced admin time across employees and finance

Quicker reimbursements, improving employee satisfaction

Better visibility of mileage as part of overall spend

It’s no surprise that in a recent survey, 87% of CFOs said they are investing in expense automation, and 70% of finance teams listed real-time expense insight as a top priority.

Conclusion: Mileage Reimbursement Made Easy (and Accurate)

Conclusion: Mileage Reimbursement Made Easy (and Accurate)

Mileage is one of those tasks everyone tolerates, but no one enjoys – until it starts costing real money, time, and compliance risk.

When finance teams finally take control of it, the difference is immediate: cleaner claims, fewer disputes, faster approvals, and far less time wasted chasing the basics.

And that’s the point.

Mileage shouldn't be a monthly stress; it should be a simple, accurate, largely automated flow that supports your team rather than slowing it down.

The tools now exist to make that a reality, and finance teams who embrace them don’t go back.

If you’re ready to see how much smoother mileage can be with a system built for UK finance teams, book a demo with ExpenseIn.