Best Expense Tracking Software for UK Finance Teams: What to Look For & Why It Matters

Discover the best expense tracking software for UK finance teams in 2026 – with key features, comparisons, and how to choose the right fit.

Get the best advice on managing your business expenses and ensure you are managing your expenses correctly.

Discover the best expense tracking software for UK finance teams in 2026 – with key features, comparisons, and how to choose the right fit.

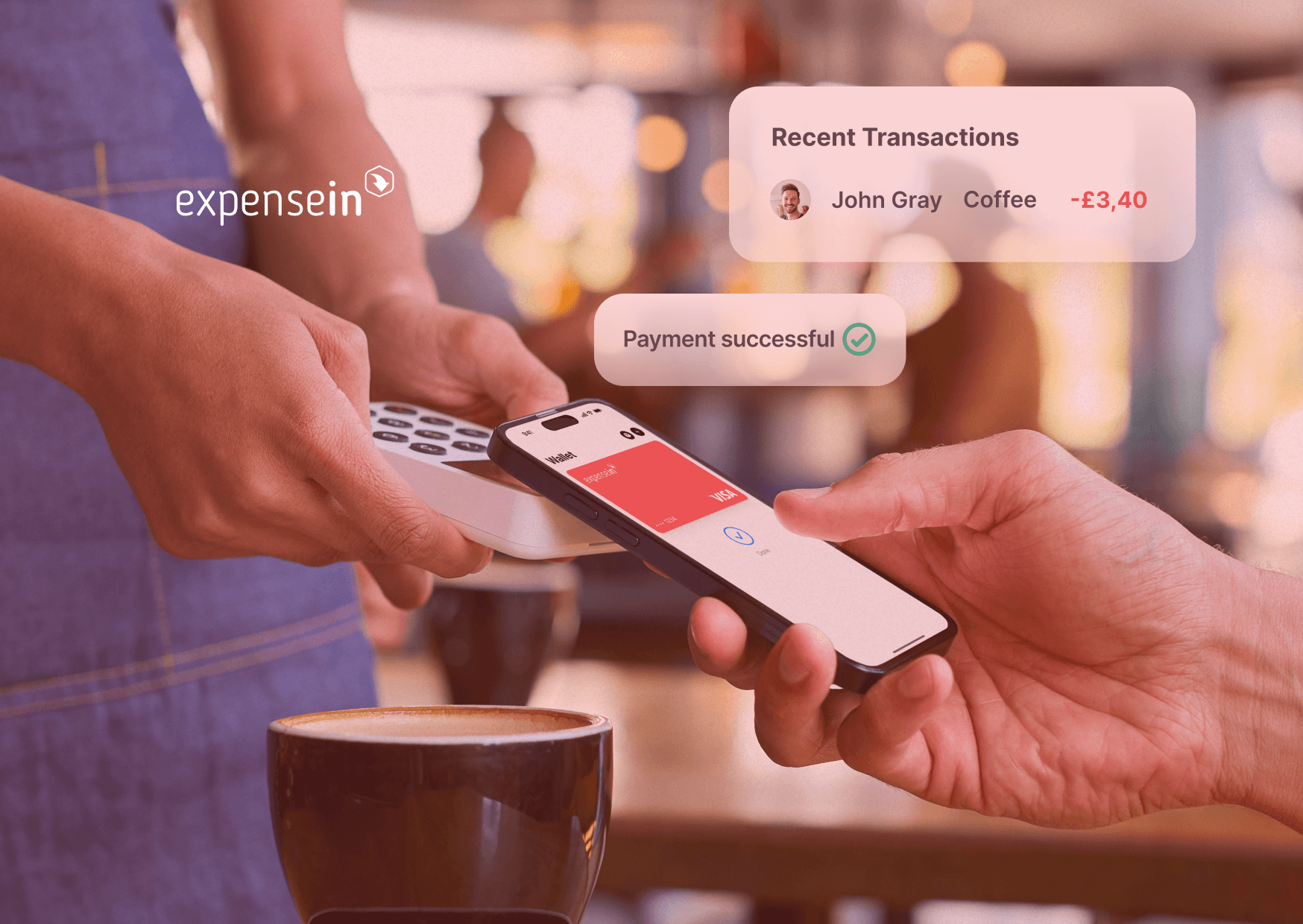

As digital wallets become the default way employees pay, finance teams face new risks and opportunities. Here’s how to manage wallets with control, security, and visibility.

Discover HMRC mileage reimbursement rules, 2025 AMAP rates, compliance tips, and how finance teams can automate mileage claims to save time and reduce errors.

Still managing expenses in spreadsheets? It’s costing your finance team far more than time. This guide exposes the hidden costs and shows 7 ways to automate expense reporting for good.

Discover how UK nonprofits can simplify reimbursements, track volunteer spend, and stay compliant with smart expense management tools.

UK and Irish finance teams are tired of finding overspend too late. Discover how virtual corporate cards help finance teams stop budget leaks, simplify reconciliation, and close the books with confidence.

Tightening budgets doesn’t have to mean slowing your business down. Discover how UK finance leaders are using automation and real-time visibility to keep spending under control.

Month-end shouldn’t mean chasing receipts. See how employee expense cards help UK finance teams stop reimbursements, gain control, and simplify spend management.

Compare the top UK business expense cards for 2025 and discover which options give finance teams the best control, compliance, and real-time visibility over company spending.