Did you know nearly half of UK employees (49%) still pay for work expenses with their own money? (Source: ExpenseIn Survey 2025)

That’s not just inconvenient; it’s a red flag for finance leaders.

If you’re a finance professional, chances are you’ve faced the ripple effects:

Out-of-pocket staff spend

Delayed receipts and reimbursements

Budget surprises

Month-end statement stress

It’s messy, reactive, and time-consuming.

But there’s a better way.

Prepaid business expense cards, especially when paired with a smart expense card app, are helping UK finance teams take back control before problems arise.

Let’s break down how they work, the real-world benefits, and how platforms like ExpenseIn are transforming business spend for good.

What is a Prepaid Business Expense Card?

A prepaid business expense card is a company-issued card that’s loaded with funds in advance, like a pay-as-you-go debit card for employee spend.

No borrowing, no credit risk, and no out-of-policy surprises.

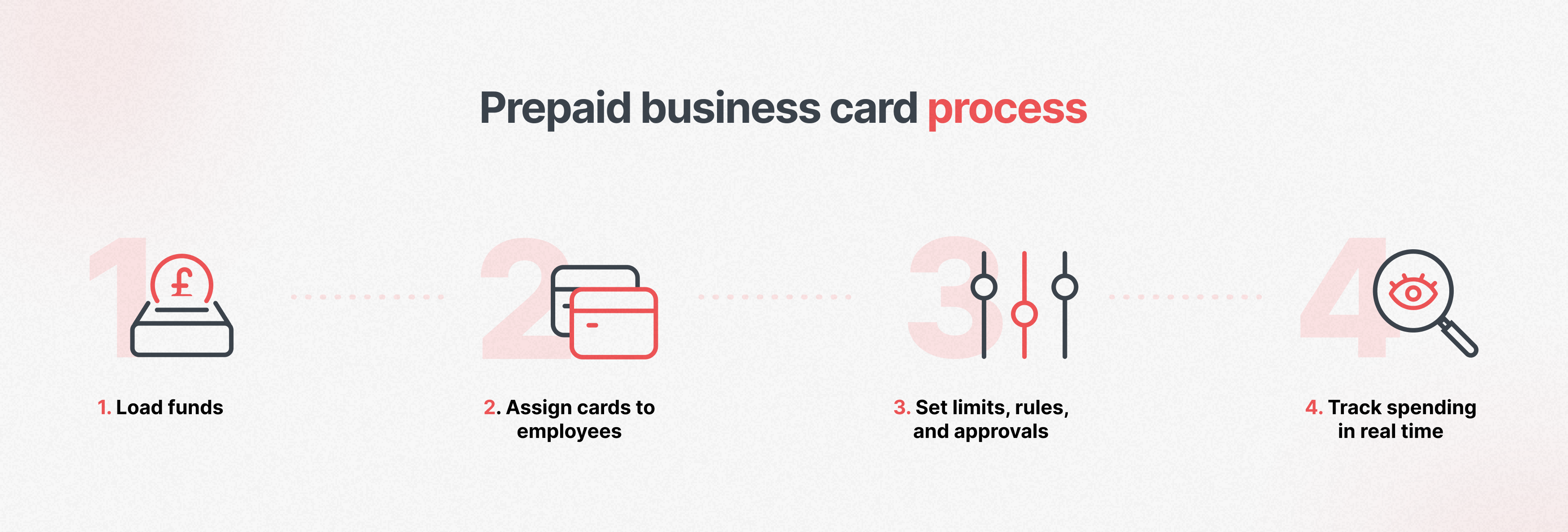

Here’s how it works:

Load funds onto the card (or a shared company balance)

Assign it to an employee or team

Set limits, rules, and approval workflows

Track spending in real time via a mobile or web app

Whether it’s travel, subscriptions, or team meals, staff spend only what’s been approved.

Transactions sync automatically with your expense management system, eliminating manual admin.

Why UK Finance Teams Are Turning to Prepaid Business Expense Cards

From tighter controls to faster workflows, prepaid cards are quickly becoming the tool of choice for modern finance teams.

Let’s look at the biggest advantages:

1. Set spend limits before the money leaves

With prepaid business expense cards, you don’t just monitor spend – you set the boundaries upfront.

Whether it’s a £200 monthly cap for online ads or restricting card use to hotels and travel merchants, you decide:

How much is available

Where the card can be used

When it can be used

What happens if someone tries to break the rules (hint: the transaction gets blocked)

With traditional credit cards, you often find problems after the money’s been spent. Prepaid cards turn that process on its head.

💡 With ExpenseIn, you can assign/freeze cards, configure custom spend rules, and even block specific merchant categories – all from a central dashboard. Learn more about the ExpenseIn card.

2. End reimbursements (and employee frustration)

According to national survey data, 81% of employees say they’ve been left out of pocket for over a month waiting to be reimbursed by their employer.

And in a separate report, 43% said those delays caused them real financial difficulty, from missed bill payments to personal credit issues.

With prepaid cards, approved funds are ready before spend happens. No more chasing receipts or delays in getting paid back.

💡 ExpenseIn’s expense card eliminates reimbursements entirely. Staff spend directly from their allocated balance, and receipts can be uploaded in real time through the mobile app. Learn more about ExpenseIn’s mobile app.

3. See every transaction in real time

Expense blind spots aren’t just annoying; they’re widespread.

A 2025 UK study found that 87% of companies experience “shadow spend” – untracked purchases made outside of official processes, often resulting in budget overruns or compliance issues.

Unlike traditional corporate credit cards, prepaid card systems give you live visibility into every transaction.

With the right prepaid business expense card app, you can:

See who’s spending, what they’re spending, and where

Get alerts for high-value transactions

Track budgets by team, project, or category – instantly

💡 With ExpenseIn, live spend data is paired with powerful reporting tools, so you can make informed decisions, not end-of-month guesses. Learn more about ExpenseIn’s real-time reporting.

4. Simplify reporting, VAT, and compliance

Each card transaction is automatically captured, timestamped, and (with the right system) matched to a receipt.

This means:

No lost paperwork

Easier VAT recovery

Faster reconciliation

A full audit trail at your fingertips

💡 ExpenseIn connects every card transaction to an expense entry and receipt, then pushes that data to your accounting system (Xero, Sage, AccountsIQ, etc.) with no manual entry required. See how ExpenseIn integrates with your accounting software.

5. Protect against fraud and misuse

Poor spend controls don’t just create inefficiency; they open the door to fraud.

One 2024 UK survey found 24% of employees admitted to sneaking personal purchases through as business expenses.

Prepaid business cards offer far better security than shared corporate credit cards or petty cash:

Set hard spending limits

Instantly freeze or cancel cards

Issue one-off virtual cards for subscriptions or contractors

Block risky merchant types

💡 ExpenseIn’s cards come with built-in safeguards to help you spot and prevent misuse before it becomes a problem. Learn more about the ExpenseIn card.

Prepaid Business Cards: What to Watch Out For

While prepaid cards solve many problems, they’re not perfect for every situation.

Some trade-offs to consider:

No credit building: You’re not borrowing, so prepaid cards don’t improve company credit scores.

Cash flow planning is essential: You’ll need to pre-fund expenses, which can tie up working capital.

Rewards are limited: Unlike credit cards, most prepaid options don’t offer points or cashback.

Some cards come with hidden fees: Always check for top-up fees, foreign transaction charges, or ATM withdrawal costs.

That’s why choosing the right UK prepaid card provider is key.

How to Choose the Right Prepaid Business Expense Card App

Here’s what to look for when comparing providers:

Integrated expense management: Look for a card that connects seamlessly to your expense workflows.

Granular spend controls: Set daily/weekly limits, restrict categories, and approve funds in real time.

Mobile-friendly app: Ensure employees can capture receipts, check balances, and submit expenses on the go.

Accounting integrations: Choose a platform that syncs with your accounting software to reduce manual work.

Reporting & analytics: Real-time data helps you stay on top of budgets and spending patterns.

UK + Ireland availability: Make sure the card supports businesses in your region with localised support.

Even with the best intentions, poor processes lead to money left on the table.

Research shows UK employees fail to reclaim nearly £690 million in out-of-pocket expenses every year, usually because of lost receipts, missed deadlines, or confusing systems.

A smarter system ensures purchases are tracked and reimbursed (or avoided entirely) in real time, with far less friction.

Why finance teams choose ExpenseIn

Unlike standalone prepaid card providers or banking add-ons, ExpenseIn combines powerful spend controls, receipt capture, and real-time policy enforcement into one fully integrated platform, built specifically for UK and Irish finance teams.

You can:

Issue expense cards with granular limits

Track spend and enforce policies in real time

Automate expense reports with seamless receipt capture

Sync directly with tools like Xero, Sage, AccountsIQ, and more

Empower employees to submit expenses on the go via mobile

With everything connected in one place, your team gets full visibility, control, and compliance – without the manual overhead.

A Smarter Way to Manage Business Spend

Today’s finance teams don’t need another disconnected tool.

They need clarity, control, and compliance, without creating more admin for themselves or their employees.

With a business expense card and app like ExpenseIn, you can:

Eliminate reimbursements

Empower staff with approved spending

Stay on top of budgets in real time

Simplify compliance and VAT processes

Reduce risk across the board

Whether you're scaling a finance team or tightening cost control, ExpenseIn helps you shift from reactive processes to proactive spend management – all within one intuitive platform.

Book a free demo to see how ExpenseIn can simplify your company’s expense process and give you the control you’ve been missing.