Let’s say the quiet part out loud: Your spreadsheet-based expense process is killing your team (and your control) far more than you think.

Finance leaders don’t cling to spreadsheets because they work. They cling to them because they’re familiar. But familiarity is a trap.

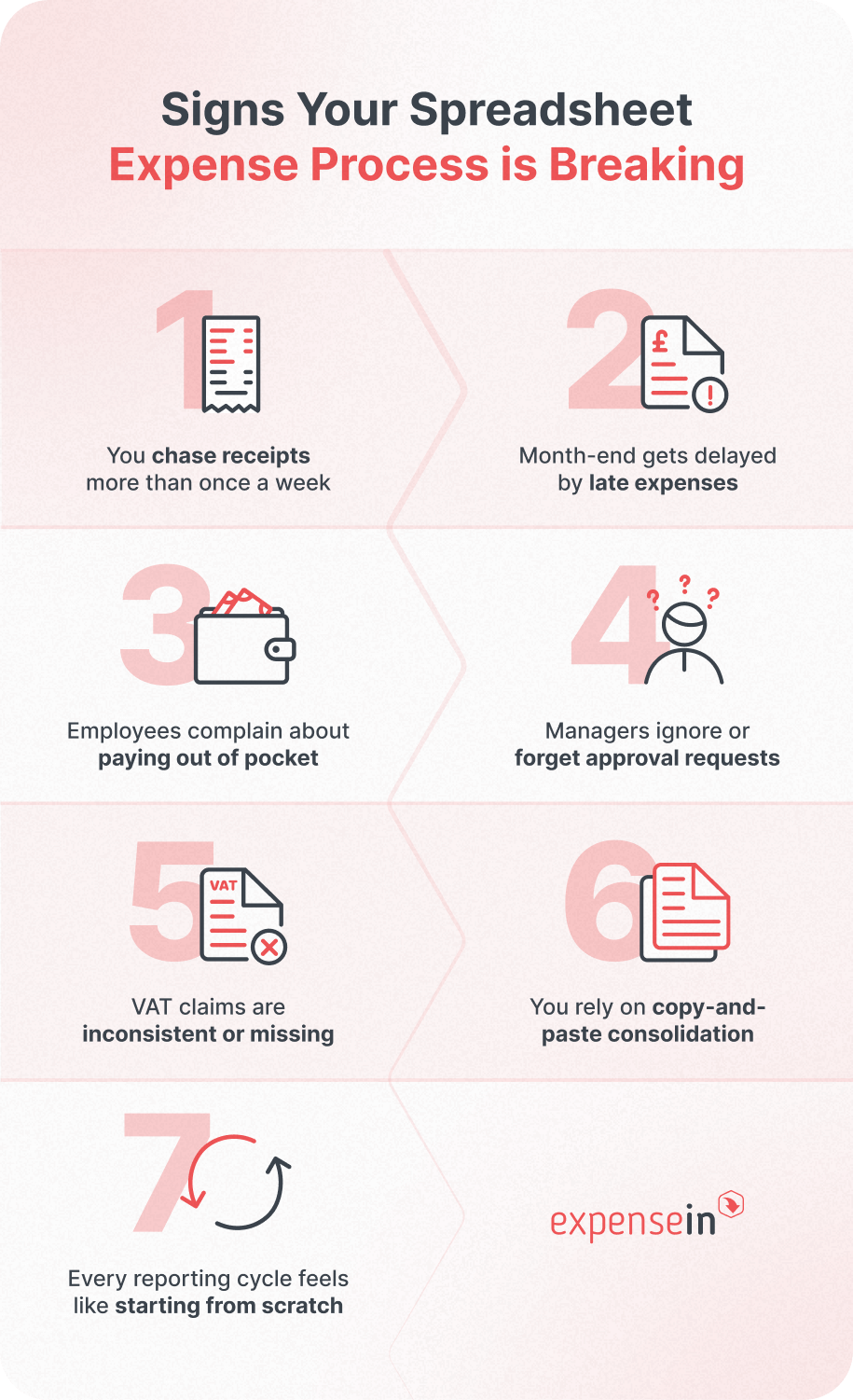

While you’re manually fixing formulas, chasing receipts, and patching errors you didn’t cause, your finance function is bleeding time, accuracy, and visibility – all in the name of “keeping things simple.”

Meanwhile, the rest of the business moves faster than ever… except expenses.

You’re stuck waiting weeks for data you needed yesterday

Employees are propping up the process with their own cash

VAT gets missed

Expense fraud slips through

Month-end drags

And the worst part? Most teams don’t even realise how much of this is self-inflicted.

Spreadsheets aren’t a system. They’re a symptom of an outdated process.

If you’re ready to see what manual processes are really costing you (and how to escape them), here’s a breakdown of the hidden costs and the seven best ways to automate expense reporting for good.

The Hidden Costs of Spreadsheet-Based Expense Reporting

Spreadsheets look “free.” But for UK and Irish finance teams, they can be one of the most expensive systems in the entire organisation.

They drain time.

They increase errors.

They inflate operational costs long before anyone notices the damage.

Below are the real, measurable costs that spreadsheet-based expense management creates.

1. Manual expense reporting wastes finance team time

Manual expense reporting is one of the biggest productivity drains in finance.

The average expense report takes ~20 minutes to process, when it’s correct.

Nearly 1 in 3 employees are chased weekly for missing receipts.

Add that up across every employee, every month, and you quickly lose days of finance time that could’ve gone into strategy, financial forecasting, or analysis.

2. Spreadsheet-based expenses are more expensive than you think

Time is money.

Each manual expense report costs ~£23 in staff time and resources.

A team of just 10 employees can rack up over £4,000 a year processing basic claims.

Spreadsheets may be cheap as software, but expensive as a workflow.

Quick cost check: If your team processes 100 expense reports per month, at £23 per report, that’s £27,600 per year spent purely on manual processing.

3. Errors, VAT issues & compliance risks in manual expense reporting

Spreadsheets are notoriously unreliable:

Each correction adds 18+ minutes per claim

Broken formulas, typos, and inconsistent formats distort your reporting and introduce financial compliance risk.

Worse: 25% of finance leaders admit they lose VAT reclaims due to incorrect or incomplete claims.

That’s money left on the table.

4. Spreadsheets delay spend visibility & slow decision-making

With spreadsheet-based reporting, finance teams often wait until month-end to consolidate data. That lag kills agility.

23% of UK finance leaders say manual processes slow their ability to manage spend

With 52% of organisations planning cost reductions, real-time visibility is no longer optional

You can’t steer the business effectively if your spend data is weeks out of date.

5. Employee frustration, policy breaches & fraud in manual processes

Manual processes hurt employee morale and compliance.

49% of employees front their own cash before claiming

38% want a simpler way to submit expenses

10%+ exaggerate claims when controls are lax

Expense fraud costs UK businesses ~£2 billion annually

Spreadsheets make fraud easier and employee experience worse.

The bottom line: manual expense reporting is costly

The good news? Every single one of these problems is avoidable.

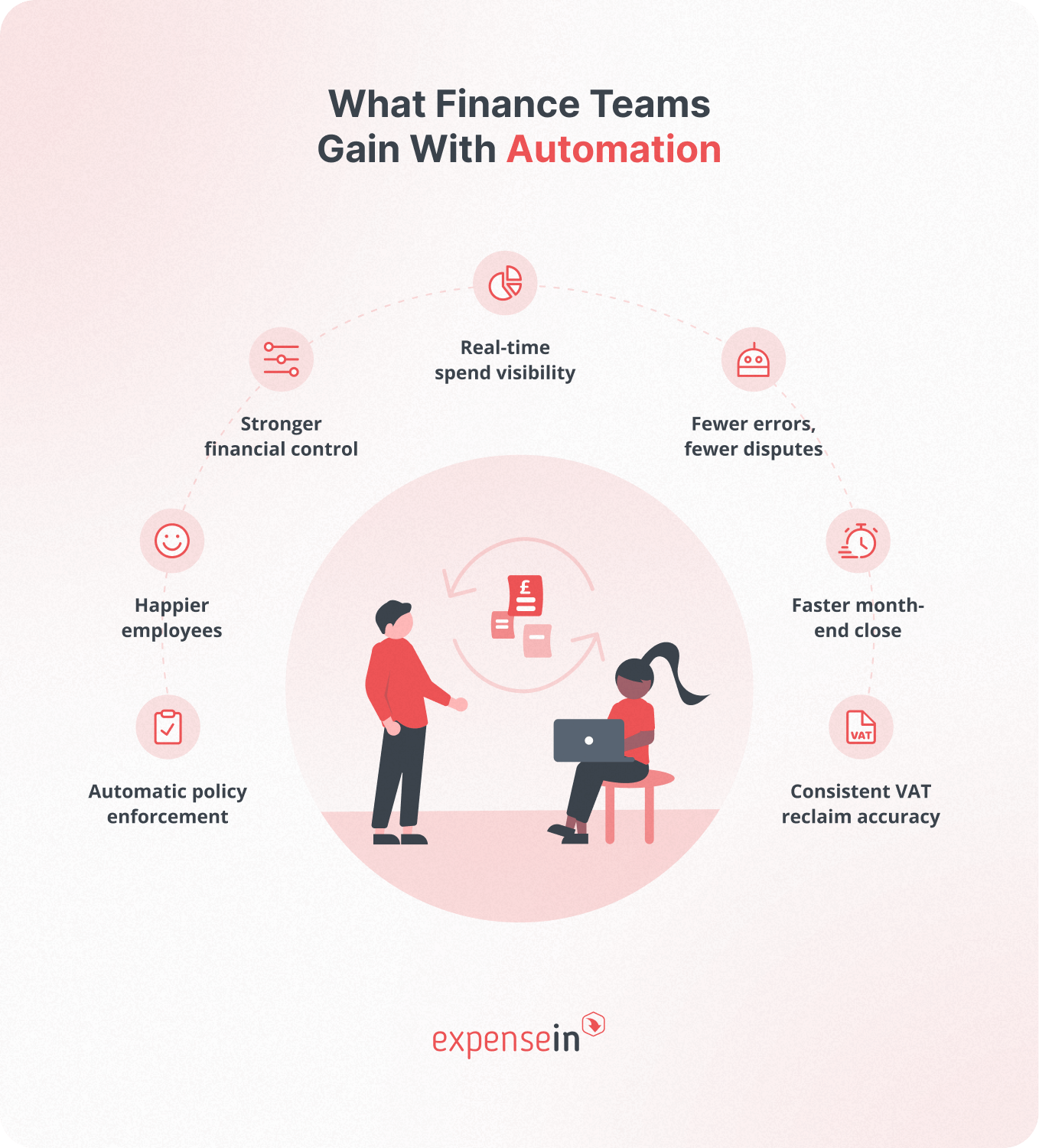

Automating expense reporting reduces processing time, minimises errors, and provides real-time visibility.

No surprise: 23% of finance leaders say manual processes are now their biggest challenge outside regulatory change.

It’s time to modernise.

7 Ways to Automate Expense Reporting & Replace Spreadsheets for Good

Automation isn’t about just “adding a tool.” It’s about redesigning the entire expense process to be faster, cleaner, and nearly hands-free.

Here are seven practical ways to eliminate spreadsheets and finally take control of expenses.

1. Use mobile receipt capture to automate submission

Employees snap a photo of the receipt with their mobile expense app as soon as they get it. It uploads instantly – no more crumpled paper, no more “I lost the receipt.”

This alone eliminates one of the biggest manual bottlenecks.

Pro tip: ExpenseIn's mobile expenses app automatically processes and attaches each receipt to the correct claim, reducing chasing and keeping everything organised without employee effort.

2. Automate data entry with OCR receipt scanning

OCR (optical character recognition) extracts key data (merchant, date, VAT, amount) in seconds, with far fewer mistakes than manual entry.

The expense is effectively “in the system” immediately.

Pro tip: ExpenseIn’s real-time receipt scanning captures VAT lines accurately and auto-categorises spend, speeding up submission and approval.

3. Integrate company cards for automatic expense import

With card integration, each transaction flows into the expense system automatically – often in real time.

Employees stop paying out of pocket. Finance stops manually matching receipts to statements.

Pro tip: The ExpenseIn Card pushes transactions into the platform as soon as they happen and automatically links them with the matching receipt your employee has just snapped. That means no more end-of-month matching, and finance gets instant visibility of spend as it occurs.

4. Automate policy enforcement & compliance checks

Spreadsheets depend on someone spotting issues, which isn’t realistic when hundreds of lines come through monthly.

Automated expense management software checks every claim against your rules:

Spend limits

Required receipts

Blocked merchants

HMRC rates

VAT requirements

Out-of-policy items are flagged instantly or blocked entirely.

Pro tip: ExpenseIn's automated policies allow different rules for different teams or roles, offering control without rigid one-size-fits-all policies.

5. Streamline approvals with automated workflows

No more chasing spreadsheets through email purgatory.

Automated approval workflows:

Send claims to the correct approver instantly

Allow one-tap approvals

Eliminate bottlenecks

Provide full visibility into status

Pro tip: ExpenseIn's advanced expense approvals support multi-step routing and auto-approvals for low-risk claims, keeping everything moving without manual intervention.

6. Sync your expense management software with accounting systems

Integrations with AccountsIQ, Sage, Xero, QuickBooks and more allow approved expenses to post automatically into the general ledger.

No rekeying.

No importing.

No copy-paste.

Pro tip: ExpenseIn’s accounting integrations include VAT handling and HMRC-compliant digital record-keeping, ensuring accurate returns with no manual reconciling.

7. Use real-time reporting & analytics to improve spend control

Once everything flows automatically, you unlock the real value: real-time insight.

Real-time reporting dashboards replace manual pivot tables, helping finance leaders:

Spot spend trends early

Track budgets proactively

Flag anomalies instantly

Prepare reports in seconds

Pro tip: ExpenseIn’s real-time reporting lets you drill into spend without exporting anything to Excel – perfect for quick budget checks, board reporting, or investigating unusual activity on the fly.

Why Finance Teams Should Finally Move Beyond Spreadsheets

Why Finance Teams Should Finally Move Beyond Spreadsheets

Spreadsheets might feel comfortable, but comfort is exactly why they’ve become such an expensive habit.

The evidence is clear: manual expense reporting is actively undermining accuracy, control, and the credibility of your financial data.

The encouraging part? None of this is permanent.

The moment you automate, everything changes:

Bottlenecks disappear

Errors drop

VAT accuracy improves

Visibility returns

And finance finally operates at the speed your business demands

Even adopting a few of the tactics in this guide is enough to break the cycle and hand finance leaders back the time, oversight, and strategic headspace that manual processes quietly erode.

If you’re ready to stop fighting your tools and start leading with clarity, ExpenseIn brings all of this automation together in one intuitive platform. Book a quick demo and see just how quickly the spreadsheet chaos can disappear.