Imagine this…

It’s a Monday morning, and you’re scanning your team’s corporate card transactions. A weekend charge at an electronics store catches your eye – no context, no receipt, and no obvious business reason. No one flags it. No one explains it.

That’s how it starts.

In today’s day and age, where business expense cards are the norm, misuse is often subtle and dangerously easy to overlook. From “accidental” personal purchases to deliberate fraud, corporate card abuse is real, rising, and deeply costly.

KPMG's Fraud Barometer reported that in 2023, UK businesses faced nearly £1 billion in losses due to employee-related fraud.

The worst part? Many companies don’t see it coming. And those red flags? They were there all along.

The Hidden Cost of Corporate Card Convenience

Corporate cards, whether traditional credit or company expense card programs, have become essential.

They streamline business spending, eliminate expense reimbursement headaches, and empower employees to get things done.

But convenience can come at a cost.

32% of occupational fraud stems from a lack of internal controls

19% of cases happen when employees override existing safeguards

Many companies lose 5% of their annual revenue to fraud, much of it expense-related

And it doesn’t take much. From small policy violations to million-pound frauds, the warning signs often look the same if you know what to look for.

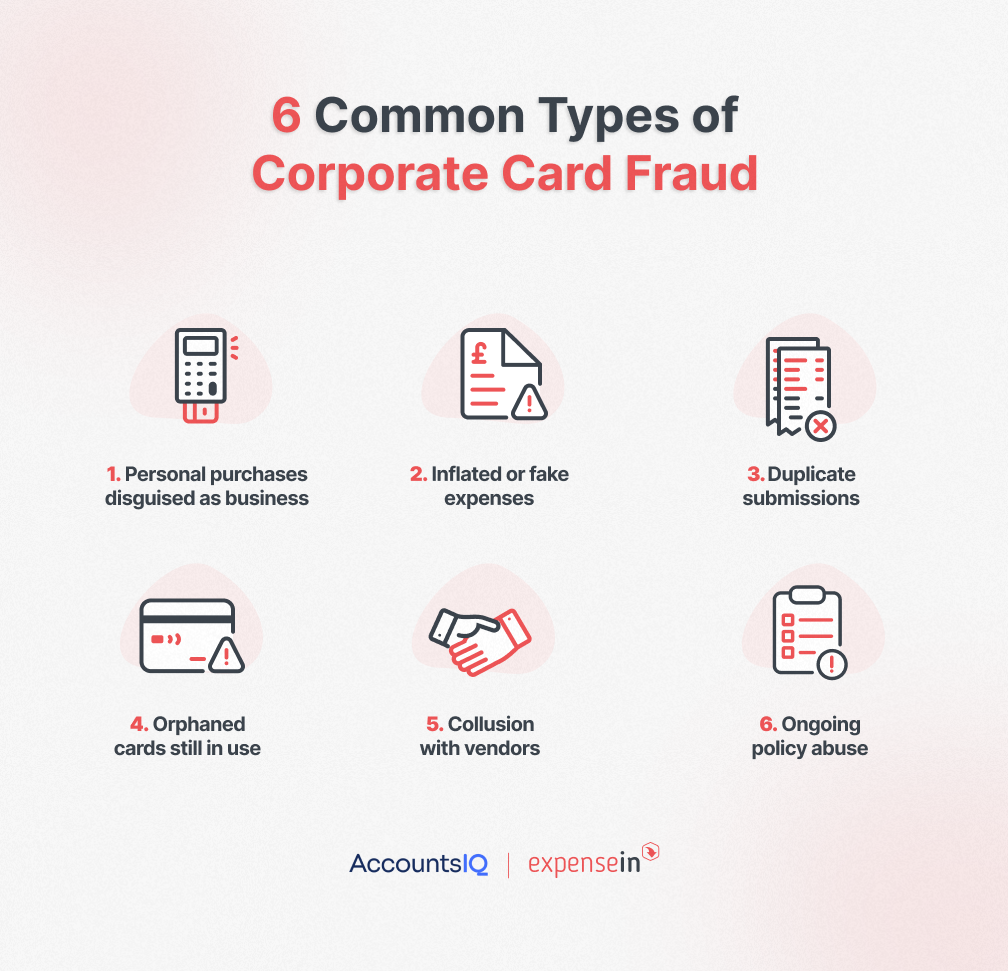

6 Common Corporate Card Fraud Schemes

Before diving into red flags, here’s what expense fraud can look like behind the scenes:

Before diving into red flags, here’s what expense fraud can look like behind the scenes:

1. Personal purchases labelled as business

An employee claims a family dinner was a “client meeting,” or buys personal electronics and logs them as “IT equipment.” It happens.

2. Inflated or fictitious expenses

Think blank taxi receipts filled out later, or entire fake events and services.

3. Duplicate claims (double dipping)

An expense charged to a card and submitted for reimbursement. Or the same receipt, submitted twice.

4. Orphaned cards still in use

A former employee’s card wasn’t deactivated. Months of rogue spending follow. Or a stolen card is used online undetected.

5. Collusive vendor scams

An employee colludes with a vendor to bill for fake services, pocketing the proceeds.

6. Ongoing policy abuse

Booking first-class instead of economy. Dining at five-star venues. Repeated, unchecked overspending.

These range from nuisance-level leakage to serious embezzlement, and the most dangerous part is how easily they slip through when Finance isn’t watching in real time.

7 Red Flags in Employee Business Expense Card Use

Fraud doesn’t hide. It leaves patterns.

Watch for these telltale signs in your business expenses card program:

Watch for these telltale signs in your business expenses card program:

1. Missing or vague receipts

No documentation? That’s a problem. Generic or incomplete receipts (e.g. no vendor, no date) are a classic smokescreen.

2. High or frequent spending in specific categories

One employee constantly maxes meal budgets or books luxury hotels? That’s not a coincidence – it’s a pattern.

3. Rounded numbers & just-below-threshold spend

Lots of £99 purchases when the receipt thresholds start at £100? That’s gaming the system.

4. Personal items hidden in miscellaneous categories

Look out for vague entries like “supplies” or “software” that don’t align with an employee’s role.

5. Odd timing

Weekend charges. Late-night bar tabs. Monday morning travel bookings for “urgent” Friday meetings? Unusual timing deserves scrutiny.

6. Duplicate or overlapping expenses

Two employees claim the same dinner. One expense appears in multiple reports. If it feels familiar, it might be.

7. Shared cards & ghost cards

If you can’t say exactly who used the card, or if someone who’s left the company is still charging, that’s a risk screaming for a process fix.

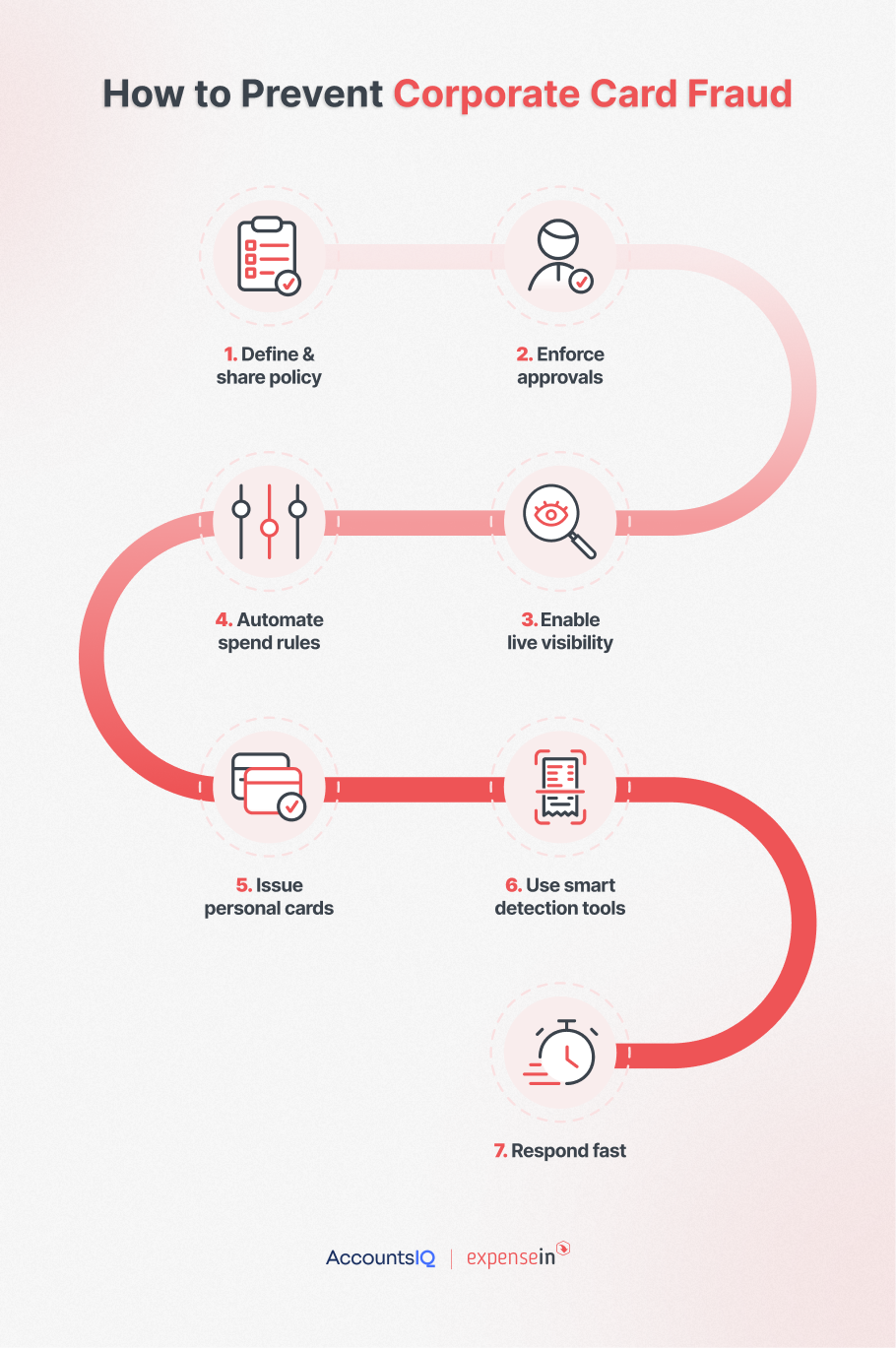

How Finance Teams Can Stop Corporate Card Fraud

Corporate fraud is a symptom. The cure is clarity, accountability, and visibility.

Here’s how to get there:

Here’s how to get there:

1. Set (& enforce) a clear policy

Your corporate expense card policy should include:

Who gets a card and why

What spend is permitted vs. prohibited

Receipt and submission deadlines

Escalation for breaches

Train all cardholders and have them sign off. Then retrain regularly. Fraud prevention starts with clear expectations.

2. Use multi-level approvals

Never let one person sign off on their own expenses.

Route every card transaction through a manager

Escalate large or out-of-policy spend to finance

Spot-check expense types for high-risk categories

Pro Tip: Make expense approval part of performance management for budget holders. Accountability matters.

3. Enable real-time spend visibility

Month-end is too late. Your finance team should see spend as it happens, not after.

Use tools that:

Feed in transactions instantly

Flag anomalies based on patterns

Let you filter by category, role, region, or employee

4. Automate controls at the point of purchase

Don’t rely on after-the-fact audits. Instead:

Cap daily or monthly spend by cardholder

Restrict merchant types (e.g. no personal retail, gambling, luxury goods)

Require receipts to be attached immediately

With employee business cards like ExpenseIn’s expense card, this is all possible and automated.

5. Issue individual cards (& never share)

Assign every employee their own card. That way:

You know exactly who spent what

You can tailor controls per person

There’s no hiding behind a shared account

It’s also easier to freeze or adjust a card if issues arise.

6. Let technology flag the red flags

AI and automation can:

Detect anomalies in timing, amount, or geography

Catch duplicates

Validate receipts

Trigger alerts for out-of-policy spend

Your team shouldn’t spot fraud by chance. Your tools should spot it first.

7. Act fast & set a standard

If you spot misuse:

Freeze the card immediately

Investigate with HR or internal audit

Recover funds if needed

Escalate legally if appropriate

Just as important: Recognise good behaviour, too. Celebrate policy compliance and transparency.

How ExpenseIn’s Expense Card Prevents Fraud (By Design)

Fraud prevention isn’t just about catching bad actors – it’s about eliminating the loopholes they exploit. That’s exactly what ExpenseIn’s expense card was built to do.

Where traditional corporate cards separate payment from policy enforcement, ExpenseIn brings everything together in a single, real-time platform.

That means finance teams get full control over spend before, during, and after each transaction, without needing to chase paper trails or audit after the fact.

That means finance teams get full control over spend before, during, and after each transaction, without needing to chase paper trails or audit after the fact.

Here’s how it works:

Built-in controls that block risky spend automatically

With ExpenseIn, every card can be tailored with custom limits by employee, team, merchant category, or geography. You can:

Set daily or monthly caps

Block specific retailers or spending types (e.g. personal retail or alcohol)

Instantly freeze any card showing suspicious activity

Need to increase someone’s limit for a project? One click. Want to stop overseas spend on a card? Done.

The result: Fewer policy breaches, fewer awkward conversations, and no surprises on your next budget review.

Instant visibility across every card & transaction

As soon as an employee uses their card, the transaction appears in your ExpenseIn dashboard – complete with vendor, category, and timestamp.

This real-time visibility means red flags get spotted early, not weeks after the fact. Finance teams and managers can act fast, and employees are far less likely to push boundaries when they know every purchase is transparent.

Instant receipt capture & automated matching

The moment a card is used, ExpenseIn prompts the user to snap a receipt, which is instantly attached to the transaction and automatically matched with merchant data.

This removes the need for chasing receipts, filling in spreadsheets, or relying on memory. It also ensures audit-ready records for every transaction, cutting admin and tightening compliance at the same time.

Eliminate reimbursement fraud completely

With ExpenseIn’s, employees never need to use personal funds or submit manual expense claims.

Every business purchase is made on a company card, logged in real time, and tied to a named user.

That means:

No double claims

No “lost receipt, please reimburse”

No risk of out-of-pocket stress

All transactions flow directly into the central expense platform, giving finance a single source of truth, not a patchwork of bank statements and expense reports.

Control, oversight, & confidence – all in one platform

If your team is still using corporate cards with little control, shared accounts, or month-end reconciliations, you're operating with risk.

The ExpenseIn expense software and expense cards are designed to give you peace of mind, without adding friction for your team.

You get:

Centralised, live visibility

Granular card controls

Automated compliance

Faster reconciliation

Fewer sleepless nights

Want to see how it works in practice? Book a free demo and see how the ExpenseIn Expense Card can transform the way your business controls spend and prevents fraud.

Don’t Wait for Corporate Fraud to Teach You the Lesson

Fraud isn’t always dramatic. It starts small. But small leaks sink big ships.

Whether it’s a £100 fake taxi ride or a £1 million fake vendor, corporate card misuse is a threat finance leaders can’t afford to ignore.

The red flags are out there. Are you watching for them?

Now’s the time to:

Review your expense policy

Centralise your card management

Equip your team with tools that make fraud prevention easy

Ready to shut down corporate card fraud before it starts? Book a demo to explore ExpenseIn’s fully integrated expense card solution.