How many times before have you been offered a receipt by a cashier only to shake your head and tell them to throw it in the bin? The answer is probably hundreds. However, if you’re a business owner or employee that regularly spends money on expenses that are required as part of your job, it ought to be almost never.

This is because all of those little company expenses, paid for by you or your employees, need to be accounted for when it’s time to complete your tax return. Acting as audit protection, all of these small pieces of paper really do add up – they’re a way of proving your spending and potentially reducing your bill.

That’s why you really do need to keep some record of your expenses. Luckily, this blog post is going to teach you exactly how to do that in an easy and efficient manner.

Image: ©Kameleon007 via canva.com

Image: ©Kameleon007 via canva.com

1. Keep an organised record of your expense receipts

It’s always handy to have receipts, if only so that you can return an item and get it refunded in full, but where you’re planning on using them as evidence of your expenditure, it’s essential that you can produce them at any time. To make sure that you can do this, you need to have them to begin with, which is why you should always accept that bit of paper you’re offered. However, keeping all that paper categorised and physically stored somewhere safe can lead to a pretty disorganised state of affairs. A far better idea is to use an application that allows you to take pictures of your receipts using receipt-scanning software, as you’ll then be able to easily separate and organise them virtually.

2. Keep track of those important details

Keeping your receipts isn’t enough when it comes to expenses, because it’s all too easy to forget what it is that they actually prove. This is why we suggest making notes to go alongside your receipt record, detailing their business purpose. This is especially handy when they relate to dining and entertainment expenses, as although you’re likely to remember exactly why you bought that new laptop or invested in a scanner, it’s often a lot harder to recall who were you eating with at an Italian restaurant in the December of last year and what the purpose of the meal was. Many of those who claim expenses just write on the back of their receipts in pen, but again, this is a relatively antiquated way of doing things with better methods now available. With an App like ExpenseIn, you’ll be able to attach memos to each individual receipt, so you can quickly type out your notes whilst on the move, before you forget. It will also make the process a lot faster later on when it comes to actually claiming your expenses, as you’ll be able to simply copy and paste from the app, rather than sorting through hundreds of pieces of paper in a drawer and trying to decipher a hastily written note in biro from a few months ago.

3. Understand how to process different payment methods

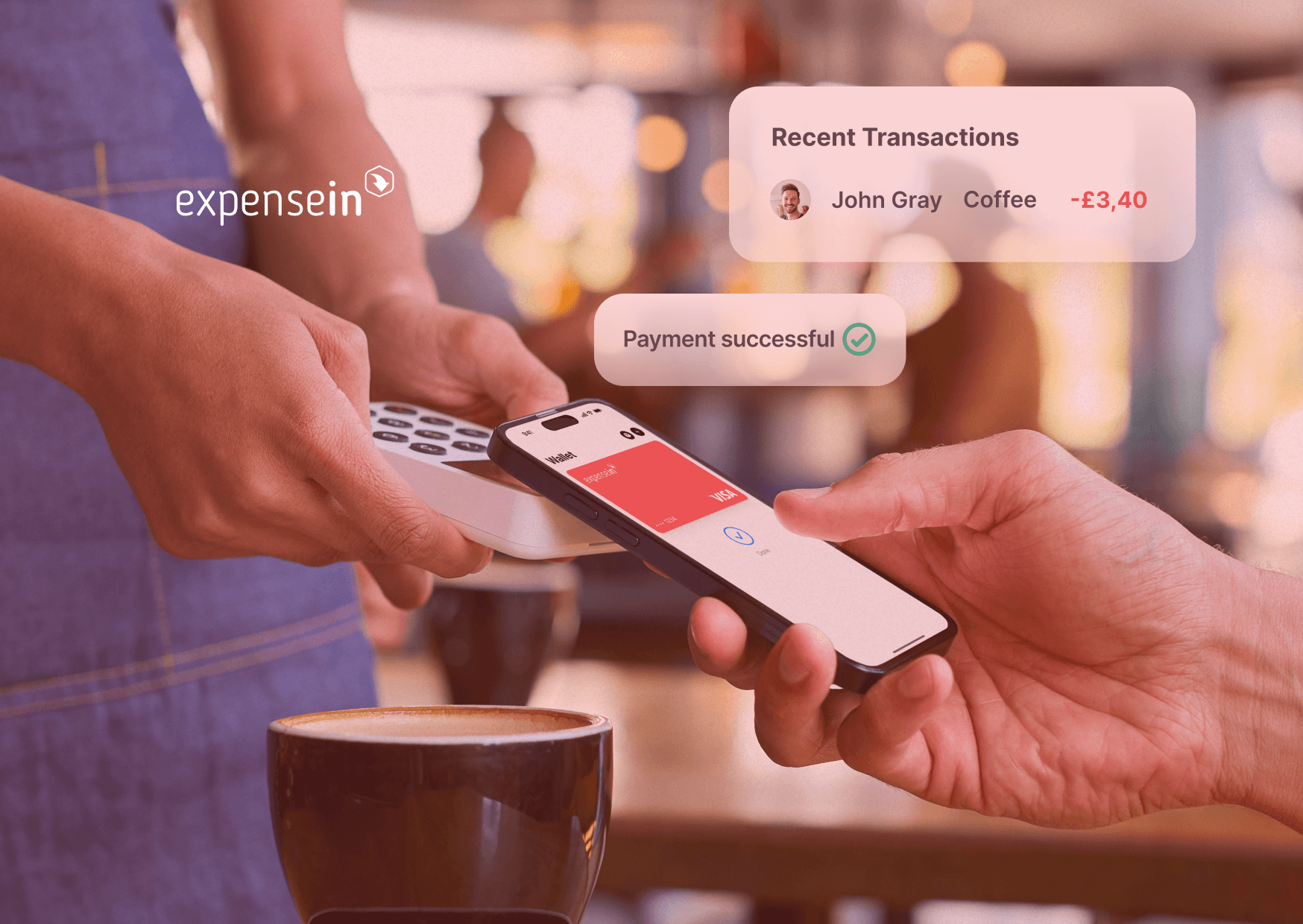

One common misunderstanding about keeping a record of your expenses is that it’s difficult to reconcile any cash payments with receipts. However, this just isn’t the case, and often using a company card, or a credit card, can end up way more complicated than just paying with cash. If you’re using the right app, such as ExpenseIn, keeping track of your expenses is an easy process. It’s simply a case of understanding the separate procedures involved with cash and card payments.

Whichever way you’re paying for your expenses, we’ll help you to record your receipts in the easiest and most efficient of manners, so that you can maintain a reliable record and create expense claims in seconds.