What Types of Business Expenses Can I Claim as a Limited Company in the UK? (FREE List)

If you run a limited company in the UK, knowing what expenses you can and can’t claim at tax time is vital. After all, you want to stay on HMRC’s good side, plus reducing your profit and Corporation Tax payment also keeps your business more tax efficient.

Thankfully, we’ve taken the confusion out of what your limited company can claim as expenses. In this in-depth guide, you’ll read about the rules for claiming business expenses, as well what you and your employees can claim, how you can keep a record of these expenses, and how you can ensure your staff comply with the rules.

Image: ©zolak via canva.com

Image: ©zolak via canva.com

Rules About Claiming Limited Company Business Expenses

When claiming business expenses for your limited company, there are some rules you must follow. We’ve outlined each of these below:

You can only claim for expenses incurred “wholly, exclusively and necessary” during the day-to-day operation of your business.

Expenses which have a dual purpose for both business and personal use cannot be claimed. This includes clothing you purchase to wear at work, yet which isn’t protective gear, for example.

Business expenses can be paid through your company’s bank account, or you can reclaim the costs of business expenses paid by you and later reimbursed via your company.

The majority of limited company expenses can be offset against your company’s corporation tax liability, with some exceptions.

You should always keep all of your receipts and invoices to prove that any claims you have made have been legitimate.

Different Types of Expenses You and Your Employees can Claim

Claiming allowable expenses can substantially reduce your limited company’s Corporation Tax liability. Unfortunately, many limited companies in the UK aren’t aware of what they can claim as business expenses, and therefore end up overpaying in tax and losing out on additional profits.

Here’s a list of many of the expenses you and your employees can claim at tax time.

Health check and eye test expenses

For many employees, work involves looking at a screen for most of the day. These employees can therefore claim eye tests, as well as health checks, as limited company expenses. If things such as glasses or contact lenses are used strictly for the screen-based work which is part of their job, then an employee may also claim these.

Business insurance expenses

Did you know that the cost of business insurances such as public liability insurance, employers’ liability, professional indemnity insurance, and contents insurance can be claimed by a limited company? Of course, this is applicable if they are only used for business purposes.

Advertising, marketing, and PR expenses

If your company utilises advertising, marketing, or PR services, then these too can be claimed as limited company expenses. It doesn’t matter if the service is ongoing or a one-off cost either – as long as it is strictly for business, then you can include it.

Accommodation expenses

If a business trip requires an overnight stay away from home, then these accommodation costs can also be claimed. As for any food and drink you consume while on this business trip? They can be claimed as travel and subsistence costs too.

Bank charges

If your business bank accounts also incur bank fees, such as credit card and loan interest, these too can be claimed as allowable business expenses.

Professional subscription expenses

If you subscribe to occupation-specific magazines or journals, or purchase relevant books, then you may also be able to claim these come tax time – but only if they are necessary to your business. For example, they might be vital to keep you informed of important industry changes or as a means of assessing competitors.

Phone bills

If your mobile phone and/or broadband contract is in your company’s name and used solely for business purposes, then you can claim the entire bill as a business expense.

Equipment expenses

The equipment that’s essential to help you carry out your role as a limited company director can also be claimed as company expenses. This includes things such as printers, scanners, computers, and software, for example.

Professional development expenses

Many courses undertaken for professional development or training also count as an allowable limited company expense in the UK. Before you claim, however, be sure to check that the course is eligible in regard to your role within the company.

How to Keep an Accurate Record of Your Expenses

Keeping an accurate record of your business expenses as a limited company is another vital part within this process. Failure to do so isn’t just a huge accounting mistake, but also means you’re neglecting an important company obligation.

This is because your receipts, invoices, and other expense related paperwork act as evidence to back-up your tax claims. After you file a tax return, HMRC can investigate it at any point within the following 6 years. Therefore, all of this paperwork should be kept on-hand during this period.

Often, business owners make the mistake of punching the numbers into a simple expenses spreadsheet that’s handled by employee after employee. Or worst – they file away their receipts, invoices, and more into an unkempt folder that’s hastily shoved into a desk drawer.

Thankfully, the digital age has brought about faster, more flexible technological advancements, including those which dramatically impact the way limited companies in the UK record and manage their expenses.

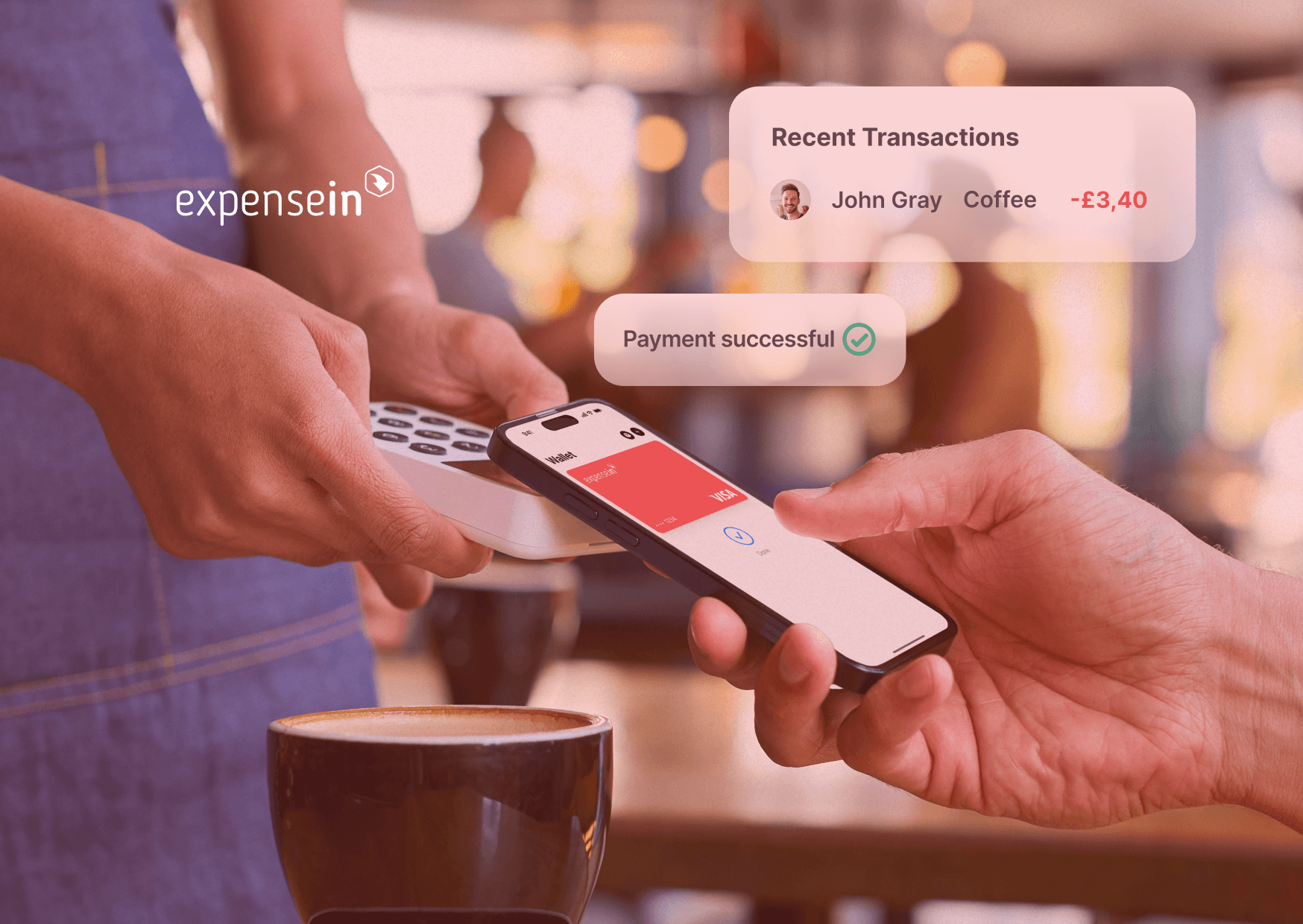

One of these advancements is ExpenseIn, which combines receipt scanning, automated policy enforcement and real-time reporting to make expense management effortless. You can replace time-consuming spreadsheets with the ExpenseIn app, which allows you to easily create, track, and approve expenses on the go.

Of course, when it comes to limited company business expenses, ensuring your staff comply with these rules is one piece of the puzzle. This is where ExpenseIn also comes in handy as it lets you configure guidelines that regulate expense claims. Plus, it includes features such as automated expense policy checks; receipt verification to automatically flag up any amount, date, and VAT discrepancies; and policy acceptance, to increase staff policy awareness.