A TravelPerk survey found that 85% of UK business travellers struggle with their company’s expense systems, and more than a quarter end up using personal credit cards and waiting for reimbursement.

At the same time, 39% of UK businesses still rely on Excel and other manual processes to manage finance.

The consequences are familiar:

Lost receipts

Unrecovered VAT

Delayed reimbursements

Finance teams scrambling at month-end

To avoid these headaches, more companies are turning to business expense cards. But not all cards work the same way.

Choosing between a debit card, a cashback credit card, or a company-issued spend card with real-time controls has a direct impact on visibility, compliance, and cash flow.

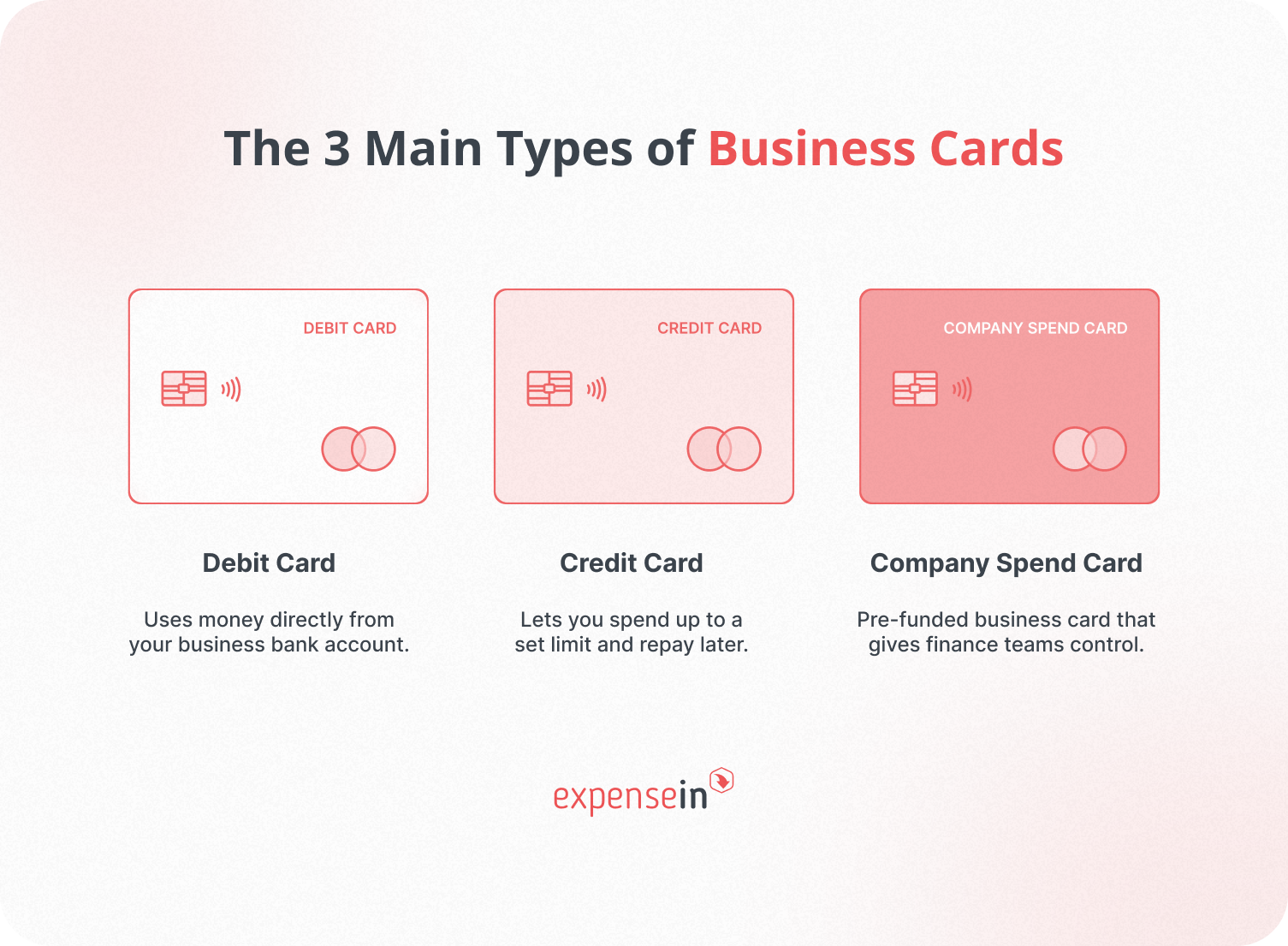

The 3 Main Types of Business Cards (and How They Work)

Before looking at providers, it’s worth clarifying the three main categories of business cards available in the UK.

Each works differently, and the choice affects how much control and visibility finance teams actually get.

Debit cards: Spend comes straight from your business bank account. They’re simple, but any misuse hits your main balance immediately.

Credit cards: Work to a pre-agreed limit, repaid later. They can come with perks like cashback or rewards, but balances carry interest if not cleared in time, and credit checks are required.

Company-issued spend cards: These are funded in advance (similar to prepaid). They reduce risk, don’t usually require personal credit checks, and give finance teams tighter control over spending. Many modern versions offer both physical and virtual business cards, making them useful for travel, projects, or online subscriptions.

Why modern spend cards are different

It’s not the card itself that makes the difference; it’s the software behind it.

Policy rules stop out-of-policy spending before it happens

Real-time receipt capture protects VAT reclaim

Approval workflows keep processes under control

Accounting integrations sync spend automatically

The real shift is visibility.

Instead of waiting for statements at the end of the month, finance teams can see, control, and reconcile spend as it happens.

The Top 6 Business Expense Card Solutions in the UK (2026)

We’ve chosen these six providers based on their relevance to UK and Irish businesses, product maturity, market presence, and independent references.

Note: This comparison is based on publicly available information as of February 2026. It isn’t an exhaustive list, and no guarantees are made regarding accuracy, completeness, or timeliness. Please check each provider’s website for the latest information.

1. ExpenseIn Card: Best all-in-one for UK & IE businesses

The ExpenseIn Card sits within the wider ExpenseIn platform, tailored for midmarket and growing businesses in the UK and Ireland.

Companies can issue physical or instant virtual expense cards straight from the platform, with each transaction automatically generating a draft expense.

Employees are prompted to upload receipts in real time, policies are enforced automatically, and approved expenses flow directly into your accounting software, leaving a complete, HMRC- or Revenue-ready audit trail without the paperwork.

Key features:

Real-time control: Set limits, block merchants, freeze/unfreeze instantly, and issue secure virtual cards and subscription cards for subscriptions, projects, or one-off purchases.

Receipts and compliance built in: Mobile expense app prompts capture VAT evidence on the spot; all receipts and approvals are stored in a compliant audit trail.

Policy enforcement at spend: Rules and approvals are applied automatically, cutting review time and reducing out-of-policy costs.

Seamless integrations: Works directly with AccountsIQ, Xero, Sage, QuickBooks and others, with accurate VAT coding.

One flexible platform: Corporate expense cards, reimbursements, mileage tracking, and supplier invoices all managed in one place.

UK/IE focus: Transparent pricing, UK-based support, and workflows designed for HMRC and Revenue compliance.

Ideal for:

Mid-market and growing businesses in the UK and Ireland that want to:

Reduce or eliminate reimbursements and expense claims

Prevent overspend and policy breaches with controls at the point of spend

Close their books faster without juggling multiple tools or spreadsheets

Issue virtual company cards instantly for subscriptions, projects, or controlled spend

2. Pleo

Pleo offers virtual and physical business cards, tied into a web/mobile expense platform.

It's widely used by startups and SMEs in the UK and Europe, with a focus on simplified expense workflows and quick adoption.

Key features:

Rapid card issuance with per-user or team spending limits

In-app receipt upload and automatic categorisation

Real-time dashboards for expense monitoring

Select plans include cashback benefits

Foreign transaction (FX) fees are applied, depending on the plan

Ideal for:

Startups and smaller businesses that want a quick-to-adopt, user-friendly tool without needing advanced policy controls.

3. Payhawk

Payhawk is a spend management platform that combines corporate cards, expense tracking, bill payments, and reimbursements.

It offers multi-currency accounts and integrates with enterprise systems, making it a strong choice for larger organisations with complex finance needs.

Key features:

Corporate cards (physical and virtual) with configurable policy controls

Multi-currency accounts with local IBANs and cross-border payment support

Integrations with enterprise software such as NetSuite, SAP, and Microsoft Dynamics

Real-time transaction tracking, approvals, and expense automation

Ideal for:

Large SMEs and enterprises operating in multiple currencies or entities needing ERP-level integration and advanced compliance features.

4. Tide

Tide provides debit expense cards linked directly to a Tide business account.

Businesses can issue up to 50 cards, each with configurable spending limits, and manage them through the Tide app.

Key features:

Up to 50 employee expense cards per account

Card management in-app: set limits, freeze, or cancel instantly

Receipt capture and auto-matching with transactions

Automatic expense categorisation and sync with accounting tools

Ideal for:

Micro-businesses and small SMEs already using (or willing to switch to) Tide for banking, and seeking a simple, bank-integrated solution for everyday spend.

5. Airwallex

Airwallex provides a multi-currency business account with physical and virtual cards.

Businesses can hold balances in multiple currencies and spend directly from matching balances to avoid conversion fees.

Key features:

Multi-currency accounts in GBP, EUR, USD, and more

0% FX fees when spending from local balances

Virtual and physical cards with freeze/cancel options

Integration with Xero and open APIs for custom workflows

Ideal for:

Businesses with significant cross-border or foreign-currency spend that want to reduce FX costs and streamline international payments.

6. Capital on Tap

Capital on Tap is a UK business credit card designed for small businesses.

It offers credit limits up to £250,000, 1% uncapped cashback, unlimited free employee cards, and no foreign transaction fees.

Key features:

Credit limits up to £250,000 (eligibility required)

Unlimited free employee cards with spend limits and monitoring in the app/portal

1% cashback on all business purchases, with no cap

No FX fees on foreign transactions

Integrations with Xero (direct feeds) and QuickBooks

Ideal for:

Small businesses that prioritise credit access and cashback rewards, while using separate expense tools or accounting integrations for deeper expense management.

Quick Comparison: The Top 6 Business Expense Card Solutions (UK, 2026)

Provider | Card Type | Standout Strength | Best Fit |

|---|---|---|---|

ExpenseIn | Company cards + platform | All-in-one: controls, receipts, compliance, accounting sync | UK/IE businesses needing full visibility + faster close |

Pleo | Prepaid + app | Easy adoption, clean UX, cashback options | Small teams prioritising speed |

Payhawk | Corporate + AP suite | Enterprise features, multi-currency, ERP links | Large enterprises with complex ops |

Tide | Debit (Tide account) | Simple setup, receipt capture, 50 cards | Small firms already banking with Tide |

Airwallex | Multi-currency debit | FX savings with 0% fees from local balances | SMEs with heavy international spend |

Capital on Tap | Business credit card | High limits, cashback, unlimited staff cards | SMEs wanting credit + rewards |

How to Choose the Right Expense Card

The right company expense card depends on fixing the specific problems slowing your finance team down.

Here’s a step-by-step process:

Here’s a step-by-step process:

1. Map your actual pain points

Be specific about what’s slowing you down:

“We’re refunding staff for out-of-pocket spend and losing VAT.”

“I only see card spend when statements arrive weeks later.”

“We’re juggling multiple disconnected tools with no single view of spend.”

Nearly 97% of UK finance leaders say fragmented systems kill real-time visibility, and that’s what leads to overspend, non-compliance, and last-minute month-end surprises.

Fix visibility first.

2. Decide where you want control: before or after spending

Before: Set limits, block merchants, pre-approve, freeze instantly → integrated cards with policy rules (e.g., ExpenseIn).

After: Reimburse claims or reconcile credit cards → requires more checking and manual policy enforcement.

3. Match card type to the use case

Virtual cards: SaaS, subscriptions, ad spend, event fees (auto-expire by project).

Physical expense cards: Travel, fuel, on-site purchases.

Credit cards: When you need a credit line or rewards, just pair them with expense software for audit trails and VAT evidence.

4. Pressure-test HMRC/Revenue requirements

Check that any provider can:

Capture receipts digitally and prompt staff in real time

Enforce VAT fields as mandatory

Retain records for at least 6 years

Export clean data into your accounts

HMRC accepts digital receipts, provided they’re complete and legible.

5. Look at the total cost of ownership (TCO)

Don’t stop at card fees. Factor in:

Per-user or subscription costs

FX and ATM fees

Setup and training time

Month-end hours saved

Platforms with real-time controls often pay back quickly in recovered VAT, fewer manual checks, and faster close cycles.

Why UK and IE Businesses Choose the ExpenseIn Card

After comparing the options, most finance leaders arrive at the same conclusion: what really saves time and reduces risk is bringing everything into one platform.

That’s why so many UK and Irish businesses are choosing ExpenseIn as their standard for expense management.

All-in-one platform: Company expense cards, reimbursements, mileage tracking, supplier invoices, and accounting sync in one place

Flexible spend model: Run cards and reimbursements side by side, tailored to your workforce

Instant virtual expense cards: Safer online spend with merchant blocks, auto-expiry, and project-based budgets

HMRC & Revenue compliance: Real-time receipt capture, VAT protection, and six-year record retention

Audit-ready workflows: Policy rules and approvals enforced before spend happens

Adoption that lasts: Easy-to-use mobile expense app, unlimited cards per user, and UK-based support

FAQs When Choosing a Business Expense Card Solution

Yes. HMRC accepts digital receipts as long as they’re legible, complete, and stored securely for six years.

Modern expense management systems help by prompting employees for receipts in real time and keeping a full audit trail.

Bank cards don’t check policy rules before spending, remind cardholders to capture receipts instantly, or code VAT automatically.

Finance teams often outgrow them because they push the admin downstream rather than preventing problems at the source.

If cash-flow flexibility or cashback is a priority over built-in controls, a business credit card may be the better option.

Just be sure to pair it with expense software to avoid messy reconciliations and compliance gaps.

Yes. Many businesses use a hybrid model:

Physical cards for frequent spenders

Virtual cards for subscriptions or projects

Reimbursements for one-off claims

The key is managing all of it in one platform.

Which Expense Card Is Best for Your Business in 2026?

Business expense cards can make life easier for finance teams, but only if you choose the right type.

Traditional debit and credit cards still have their uses, but they don’t give you the visibility, policy enforcement, or VAT protection that modern UK finance teams need.

That’s why more businesses are moving to integrated company cards with built-in expense software. Instead of chasing receipts after the fact, finance can control spend as it happens, avoiding policy breaches, safeguarding VAT, and closing the books faster.

Each solution in this guide has its strengths. But for growing UK and Ireland businesses that want cards, reimbursements, approvals, and HMRC/Revenue compliance in one platform, ExpenseIn is the obvious choice.

Ready to cut expense admin, gain real-time control, and end month-end firefighting? Book a demo today.