Think about the last time you closed the month.

How much of your team’s energy went into chasing receipts, fixing errors, and processing late claims? And how much went into the work you actually want them focused on, like forecasting, analysis, and supporting the business?

For most finance leaders, expense reimbursements steal more time than they’re worth. They leave employees out of pocket, bury finance in admin, and hide overspend until it’s too late to act.

Company expense cards flip that model.

Instead of reacting to messy claims weeks after the fact, you see spend as it happens, enforce policies automatically, and give employees the tools to pay for what they need – without dipping into their own pockets.

What Exactly Are Company Expense Cards (& How Do They Work)?

At their core, company expense cards are business-funded payment cards issued directly to employees. Unlike traditional corporate credit cards, they don’t rely on a shared credit line. Instead, spend comes from a central pot you control with built-in limits, merchant rules, and real-time visibility.

Why does this matter? Because it tackles the very problems that slow down your month-end, drain productivity, and frustrate staff:

No more out-of-pocket spend: Employees stop acting as interest-free lenders, and reimbursement delays disappear.

Receipts captured at source: Every transaction prompts an in-app photo capture that’s auto-matched.

Policy compliance built in: Set limits, block categories (e.g. alcohol, cash withdrawals), and require approvals for exceptions. Out-of-policy spend is prevented, not discovered weeks later.

Live spend visibility: See who’s spending what and where in real time.

Cleaner month-end: Transactions are auto-coded, VAT-aware, and flow into your expense workflow and accounting, reducing close time and errors.

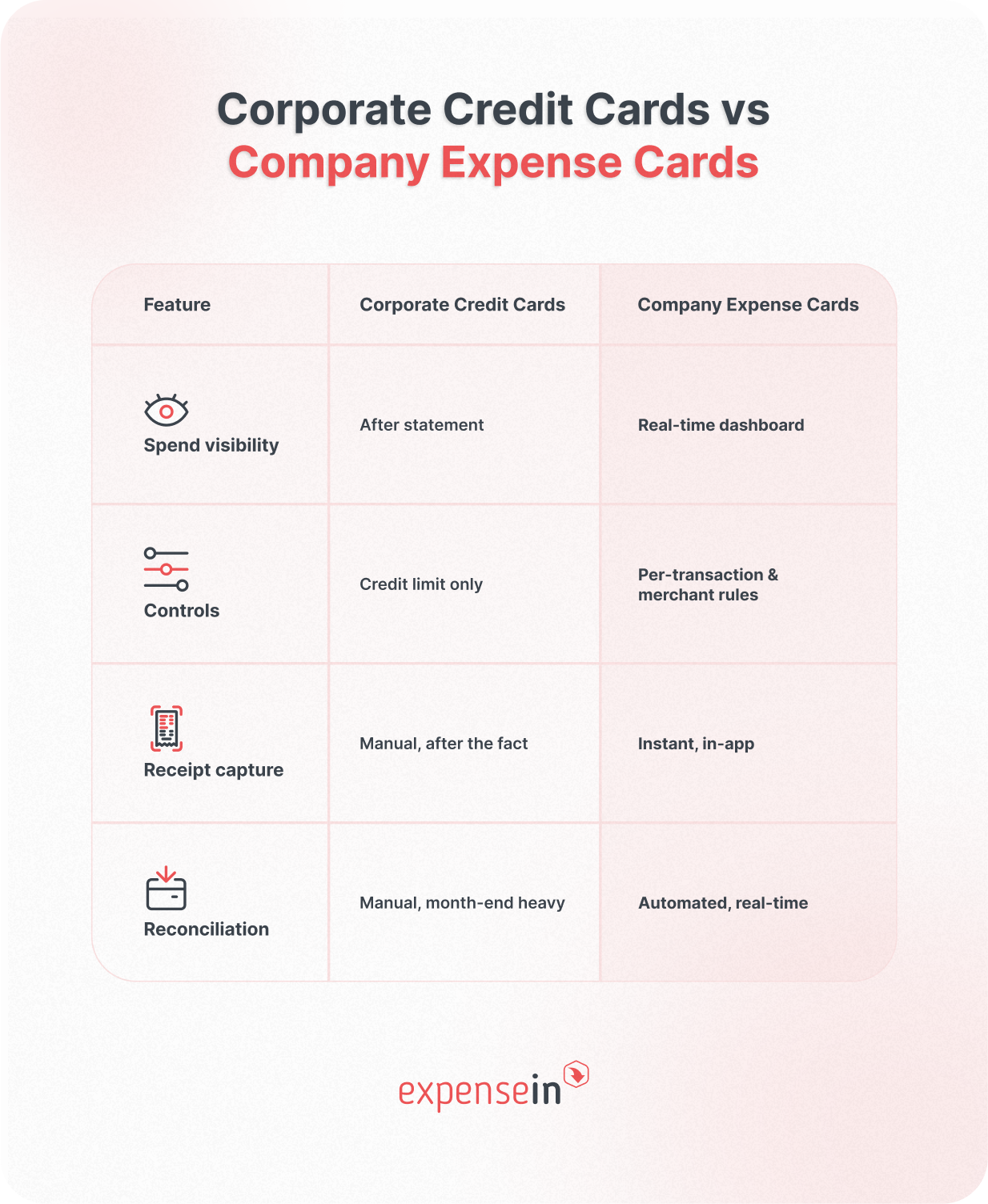

Corporate Credit Cards vs Company Expense Cards: The Key Differences

Traditional corporate cards were never designed with finance teams in mind. They give you a single credit limit and a monthly statement, so you only see spending after it’s happened.

Company expense cards flip that model. Instead of post-spend surprises, you get real-time oversight and control. Transactions appear instantly, limits can be adjusted on the fly, and out-of-policy spend is blocked at the point of purchase.

Here’s how the two models compare:

As Richard Jones, Managing Director of ExpenseIn, puts it:

"Most traditional corporate cards weren’t built with finance teams in mind. They make it hard to set controls, see spend as it happens, or connect card usage with the rest of your expense process."

Why More Finance Teams Are Replacing Reimbursements with Expense Cards

For many finance teams, expense management is still stuck in the past, showing up every day in wasted hours, frustrated employees, and unreliable data.

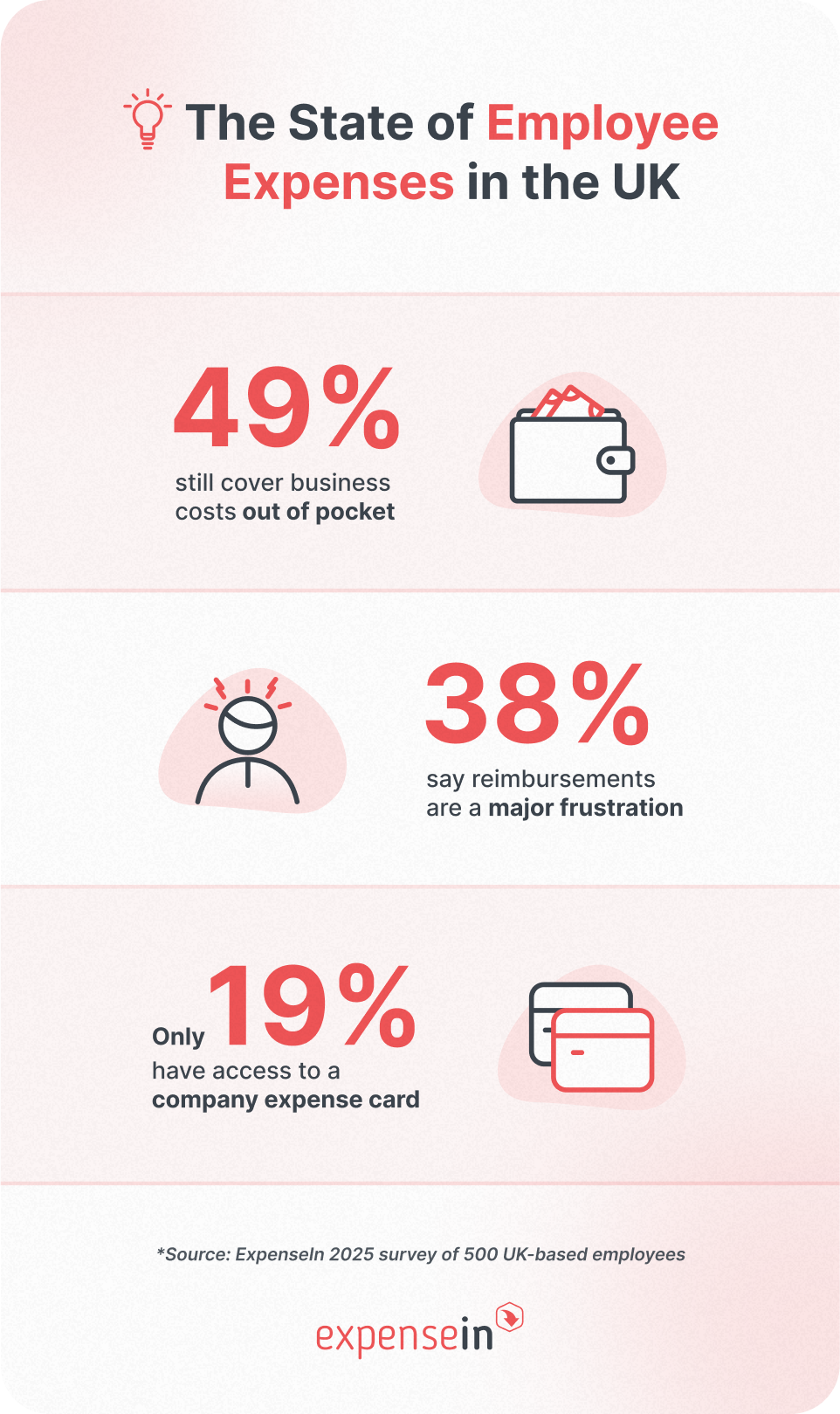

According to a recent ExpenseIn survey of 500 UK employees:

According to a recent ExpenseIn survey of 500 UK employees:

49% still cover business costs out of pocket, essentially acting as unpaid credit lines.

38% call the reimbursement process a major source of frustration.

Yet only 19% have access to a company expense card.

The impact is felt on both sides:

For employees, weeks (sometimes months) waiting for reimbursement, with 83% saying a company-funded expense card would help ease the strain during the cost-of-living crisis. When staff feel out of pocket, morale and compliance dip.

Finance teams lose hours chasing receipts and filling gaps in reports. Overspend stays hidden until statements arrive, leaving financial forecasting inaccurate.

Switching to company expense cards changes the process. Instead of surprises at month-end, you get real-time data, proactive controls, and fewer manual interventions.

Key Benefits of Company Expense Cards for Finance Teams

For finance leaders, the question isn’t whether expense management is painful – you already know it is.

The question is what happens when you replace a reactive, manual process with a proactive, automated one.

Here’s what you gain when you make the switch:

1. Real-time visibility & control

Right now, 97% of UK businesses say they don’t have real-time visibility into spend. That leaves finance teams reacting to problems instead of preventing them.

With business expense cards, every transaction appears instantly, complete with alerts and limits. You can step in before overspend spirals.

2. No more receipt chasing

Chasing employees for receipts is one of the most thankless finance tasks. Nearly 1 in 3 employees are chased weekly for missing receipts, and 1 in 10 are chased daily.

Expense cards change the workflow: employees snap receipts at the point of purchase, automatically matched to the transaction. Expense reports that essentially write themselves, and finance teams that get their evenings back.

3. Policy compliance by design

Out-of-policy claims are a hidden cost. In fact, 1 in 10 UK employees admit to regularly submitting falsified claims, with another 20% doing so occasionally.

Company expense cards build policy into the process.

You decide which categories are allowed, set transaction limits, and require approvals for exceptions. If spend doesn’t fit the rules, it simply won’t go through.

4. Smarter budgeting & reporting

98% of finance leaders say working with outdated data makes forecasting difficult.

That’s because traditional processes only give you clarity after the month closes.

Expense cards change the pace. You get real-time spend data by department, project, or category, so you can spot trends mid-month, reallocate budgets proactively, and present accurate forecasts to the board.

5. Stronger security & fraud prevention

Expense fraud costs UK businesses an estimated £2 billion annually. Shared cards and manual expense claims only make it easier for fraud to slip through.

Expense cards tie every purchase to an individual, create a clear audit trail, and can be frozen instantly.

Virtual business cards give you an extra layer of protection for one-off or online spend. It’s accountability and security in every transaction.

6. A better employee experience

Almost half of UK employees still pay out of pocket for business costs, and 38% call it a major frustration.

Add to that the fact that 69% of companies admit reimbursements are slow and inefficient, and it’s easy to see why employees are dissatisfied.

Corporate expense cards remove that stress entirely. Staff stop acting as interest-free lenders to the company, and reimbursements disappear from your workflow.

What to Look for in a Company Expense Card Provider

The wrong provider can mean hidden costs, clunky workflows, or low adoption. The right one becomes a seamless extension of your finance team.

Here are the non-negotiables you should prioritise:

Seamless integration with expense management software

The pain: Double-handling data is one of the biggest frustrations for finance teams. If card spend isn’t automatically captured and coded, you’re left reconciling statements manually and chasing receipts at month-end.

What to look for: A provider where every transaction flows straight into your expense management platform – categorised, receipted, and ready for approval.

Granular spend controls

The pain: Legacy cards give you little more than an overall credit limit, which leaves dangerous gaps in compliance. Out-of-policy spend is often only spotted weeks later.

What to look for: Real-time controls that let you set limits per transaction, block merchant categories, and build approval rules that fit your policy.

ExpenseIn gives finance teams the ability to fine-tune spend controls instantly, helping you stay compliant without slowing down employees.

A user-friendly mobile app

The pain: If employees hate using the tool, adoption will collapse, and you’ll still be left chasing receipts and late claims.

What to look for: An intuitive mobile expenses app with instant notifications, one-tap receipt scanning, and full visibility of balances and limits, so employees actually want to use it.

ExpenseIn’s mobile app is designed for ease: spend is logged the moment it happens, receipts are matched automatically, and staff always know where they stand.

Native accounting integrations

The pain: Exporting CSVs or rekeying transactions into your general ledger is error-prone and eats up hours every month.

What to look for: Direct integrations with your core systems (AccountsIQ, Xero, Sage, QuickBooks) so approved transactions sync automatically into your accounts.

ExpenseIn connects natively with all major platforms, reducing errors and speeding up month-end.

Pricing & support that fit your business

The pain: Hidden fees (foreign transaction charges, ATM withdrawals, or per-card fees) can quietly inflate costs. And when compliance questions arise, slow or unresponsive support creates real risk.

What to look for: A clear pricing model with no surprises, backed by responsive, local support that understands HMRC and Irish Revenue requirements.

ExpenseIn uses active-user pricing with rolling monthly contracts – no hidden fees, no lock-ins. Backed by a 90-second live chat response time, a 96% support rating, and a 98% retention rate, you can trust you’ll have help when you need it.

Why Finance Leaders Across the UK & Ireland Choose the ExpenseIn Card

“It frees up our finance team to focus on higher-value work like spend analysis, VAT recovery, and strengthening policy controls. And the best part? Our team genuinely love using the cards.”

That’s the difference finance leaders notice most with the ExpenseIn Card: it removes the everyday friction that slows finance teams down. Instead of firefighting at month-end, you get back the time and visibility to focus on strategic work.

Here’s why it works so well in practice:

Here’s why it works so well in practice:

One connected system: Spend cards, approvals, reporting, and accounting integrations all sit in one platform, giving finance a single, reliable view of spend.

Receipts handled via the mobile app: Every transaction triggers an instant notification, and receipts are snapped and auto-matched on the spot, reducing chasing and audit risk.

Simple funding: A central balance replaces the need to top up individual cards, keeping budgets under control without adding extra admin.

Real-time controls: Freeze a card, change a limit, or block a category instantly, stopping overspend and non-compliant purchases before they happen.

Seamless accounting integration: Approved expenses flow directly into Xero, Sage, QuickBooks, or AccountsIQ, making month-end faster and less stressful.

Flexible card options: Issue physical or instant virtual expense cards for employees, with the same real-time controls and visibility for safer, more flexible spend management.

No out-of-pocket spend: Employees use their cards for business costs, reimbursements disappear, and morale improves as staff stop acting as unpaid credit lines.

The ExpenseIn Card is designed with finance teams in mind, giving you real-time control, cleaner data, and a faster month-end while keeping employees happy.

Ready to cut the admin and take control of company spend? Book a demo and see how the ExpenseIn Card can transform the way your team manages expenses.