Almost half of UK employees still pay for work expenses out of their own pocket. If you’re running finance, you already know what that really means:

Employees left out of pocket, waiting weeks for reimbursement

Receipts surfacing late (or not at all), putting VAT recovery at risk

Budgets blown because spend only comes to light after the fact

Month-end that feels like firefighting, not closing

It’s reactive, it’s messy, and it drains hours your team doesn’t have.

That’s why finance leaders are moving to modern business expense cards. Unlike legacy corporate cards that reveal the damage weeks later, these solutions give you control and visibility at the point of spend.

But here’s the catch: not every business expense card provider delivers on that promise. Some shift the admin instead of removing it.

So, how do you separate the ones that help from the ones that just add work?

The 6 Things Every Finance Leader Should Demand from an Expense Card Provider

Here’s the framework UK finance teams use to separate card providers that add value from those that just add admin.

If a provider can’t demonstrate these in a single 30-minute demo, expect more work for your team later.

1. Integration & VAT: cards that close the books, not create spreadsheets

What to look for:

End-to-end flow: card → expense → approval → accounting

Direct sync with AccountsIQ, Xero, Sage, or QuickBooks, with VAT coded correctly

Role-based permissions, SSO, and audit-ready exports

Why it matters:

If you’re still exporting CSVs or fixing VAT codes manually, the system is just shifting admin onto your team.

How ExpenseIn helps: The ExpenseIn Card lives inside ExpenseIn’s expense platform. Each card transaction auto-creates a draft expense, prompts for a receipt, applies policy, and posts straight into your accounts once approved.

2. Controls at swipe: prevent problems, don’t patch them later

What to look for:

Per-card spend limits and merchant category blocks

Instant freeze/unfreeze

Approval workflows by amount, project, or line item

Why it matters:

Controls applied after the fact are cleanup, not prevention. Finance shouldn’t have to chase non-compliant spend weeks later.

How ExpenseIn helps: Issue cards instantly (physical or virtual business cards) and set rules that apply in real time. Overspend, blocked merchants, and exceptions are caught at the point of purchase.

3. Admin at the source: receipt capture that doesn’t rely on chasing

What to look for:

Push notifications prompting staff to upload receipts instantly

Automatic categorisation and VAT data

A mobile expenses app is simple enough that employees actually use it

Why it matters:

Despite the tech available in 2025, almost a quarter of UK businesses (23%) still run expenses on paper, and more than half rely on spreadsheets or manual forms.

That’s why late expense claims, missing receipts, and VAT losses remain so common. Every missing receipt not only costs finance hours in follow-ups, but it also directly undermines VAT recovery.

The fix is simple: capture the data at the moment of spend, not weeks later when it’s already gone missing.

How ExpenseIn helps: ExpenseIn nudges employees the second they pay: snap the receipt, attach it, done. It’s pre-coded with your defaults, so finance isn’t left chasing for weeks.

4. Costs & fees: look beyond the headline price

What to look for:

Transparent breakdown of card fees and replacement costs

No hidden charges for integrations, exports, “premium” features

Clear pricing plan that scales as your usage grows

Why it matters:

Cheap card fees paired with expensive software plans still cost you. True cost = cards + users + integrations + support.

How ExpenseIn helps: A transparent, scalable pricing model aligned with how finance teams actually use corporate expense cards. No integration or export surprises.

5. User experience: adoption makes or breaks ROI

What to look for:

A clean mobile expense app for cardholders and a clear web interface for finance

Common tasks (issue a card, change a limit, approve a claim) in a few clicks

Multi-entity support and delegation for managers and group structures

Why it matters:

Adoption is the leading indicator of financial compliance. If the tool feels clunky, staff default back to personal cards and paper.

How ExpenseIn helps: Finance teams report that ExpenseIn’s workflow feels intuitive on day one. Employees like the instant notifications; finance like the speed and visibility. Issuing cards, setting limits, and exporting to accounts are deliberately designed to be obvious and fast.

6. Compliance & support: HMRC-ready expense cards with local support

What to look for:

Evidence trail: transaction → receipt → approval → posting

HMRC-compliant VAT treatment and retention policies

UK-based support response times

Why it matters:

Audits and breakdowns can’t wait. A “global” helpdesk won’t cut it when you need HMRC-compliant evidence in seconds.

How ExpenseIn helps: A complete digital trail for every transaction, exportable in one click. Backed by UK-based support teams who understand accounting.

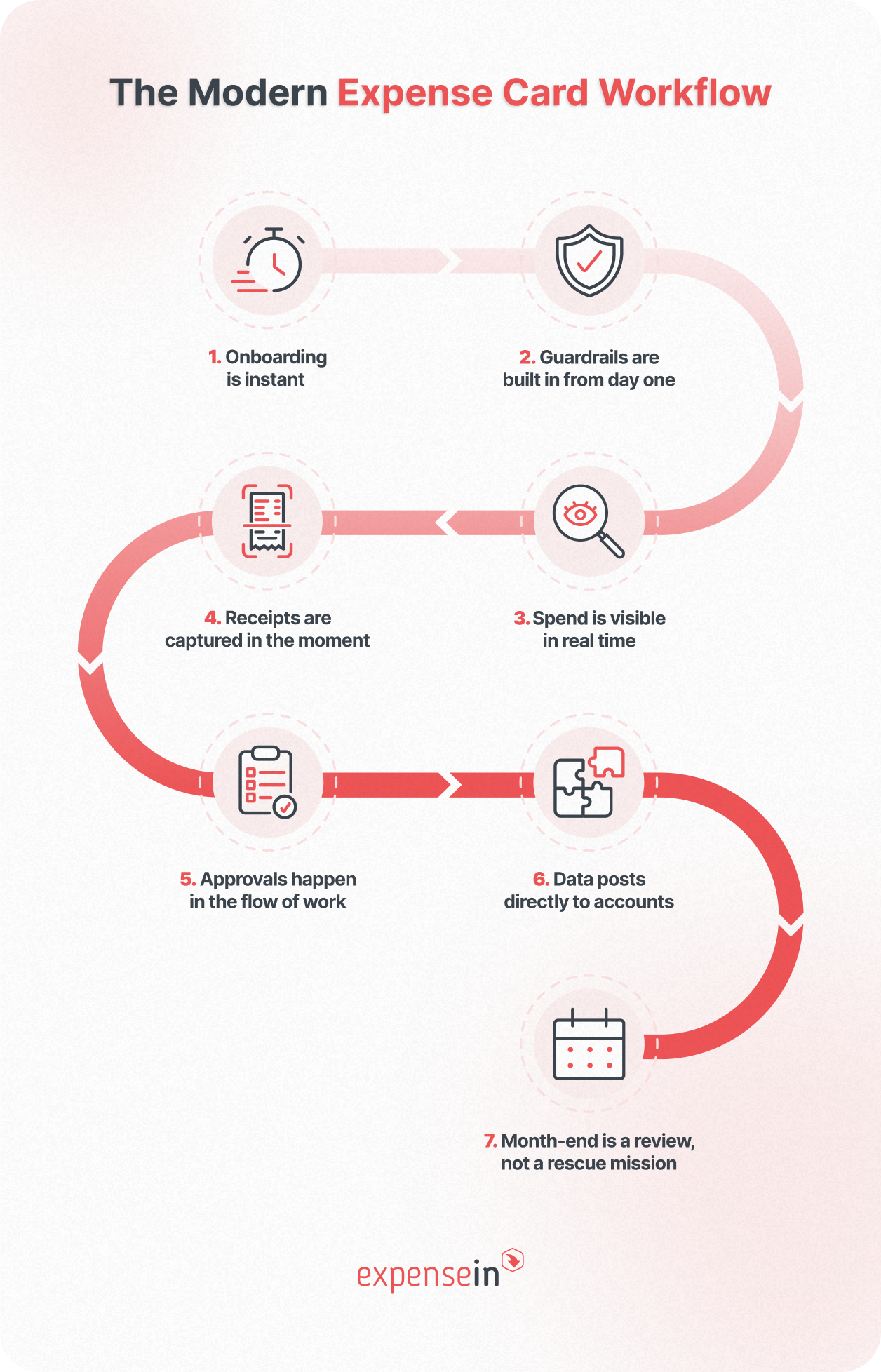

What a Best-in-Class Expense Card Flow Looks Like in Daily Life

What a Best-in-Class Expense Card Flow Looks Like in Daily Life

It’s easy for a provider to tick boxes in a demo. The real test is how the expense system performs when your team is using it every day.

A best-in-class business expense card doesn’t just make spending easier: it reduces finance workload, protects budgets, and improves month-end KPIs.

Here’s what that looks like in practice:

Here’s what that looks like in practice:

1. Onboarding is instant

A new starter joins on Monday, and by lunchtime, they’ve got a virtual expense card ready to use. No bank paperwork. No weeks of waiting.

Finance doesn’t have to run reimbursements or temporary workarounds for the first few weeks.

2. Guardrails are built in from day one

Limits, categories, and VAT defaults are set before the card is ever used. When an employee books a train ticket, they can’t accidentally overspend or use blocked categories.

Problems are prevented at source, not cleaned up weeks later.

3. Spend is visible in real time

Transactions appear on the dashboard the moment they happen.

Cash flow forecasts update instantly, so finance always has a live picture of liabilities instead of surprises at month-end.

4. Receipts are captured in the moment

Employees get a nudge on their phone as soon as they pay. They scan the receipt, and it attaches automatically to the transaction.

This is the difference between full VAT recovery and money lost.

Research shows:

UK companies lose around 12% of revenue by failing to reclaim VAT on expenses, largely due to missing paperwork.

One in four finance leaders admits they’ve had to forfeit VAT because receipts were missing or incorrect.

And HMRC reports 65% of senior finance decision-makers lose paper receipts.

Capturing them digitally at the point of spend eliminates those gaps.

5. Approvals happen in the flow of work

Line managers approve expenses on mobile between meetings. No bottlenecks. No reminders piling up at the end of the month.

Finance has continuous oversight instead of waiting for batch sign-offs.

6. Data posts directly to accounts

Once approved, the expense flows straight into accounting software, like AccountsIQ, Xero, Sage, or QuickBooks.

No spreadsheets. No re-keying. No reconciliation headaches.

7. Month-end is a review, not a rescue mission

By the time close arrives, everything is already captured, coded, and approved.

Finance isn’t scrambling to fix missing receipts or late submissions. The close is shorter, calmer, and more accurate.

Why this matters:

This flow isn’t just about convenience; it’s about making a measurable impact:

Receipt capture rates stay high, protecting VAT recovery

Real-time data means cash flow forecasts you can trust

Faster approvals reduce liability blind spots

Automated posting shortens the close cycle

These are the outcomes that separate real partners from tools that just shift admin around.

The ExpenseIn Card was designed with this flow in mind: preventing problems at source, keeping every transaction connected through to accounts, and giving finance leaders confidence that spend is fully under control.

Why UK Finance Teams Are Switching to the ExpenseIn Card

When finance teams evaluate providers, the question isn’t “what does the card do?” – it’s “can I rely on this to work the way my team, my auditors, and my regulators expect?”

That’s why more UK and Irish businesses are choosing ExpenseIn as their expense card provider.

Built for the UK and Ireland. VAT, HMRC, and Revenue requirements are supported natively, so finance teams aren’t bending global templates to fit UK rules.

Audit-proof processes. Every transaction carries a complete digital trail (from receipt to approval to posting), exportable in seconds for auditors.

Reliable, daily performance. Transactions flow in real time, every time. No broken feeds, no delayed postings – giving finance continuous confidence in data accuracy.

Expert support, not generic helpdesks. UK-based specialists who understand accounting workflows, available when you need them most.

Scales with your organisation. From SMEs to multi-entity groups, the platform flexes to growth; new hires, new entities, and tighter controls without adding admin.

“[ExpenseIn] has reduced admin time by at least 1-2 days per month. It's easy to use, efficient, their customer service team are responsive, and you can speak to a human immediately, rather than a chatbot first. I can't recommend ExpenseIn enough, having used other credit card expense software, this is the best one yet.”

Want to see how it works in practice? Book a free demo and walk through the full workflow with our team.

FAQs: CFOs’ Biggest Questions About Business Expense Cards

These are the issues finance leaders raise most often when comparing business expense card providers and how to separate marketing promises from real solutions.

Use cards for predictable categories like travel, subsistence, and subscriptions. Keep reimbursements for one-off exceptions. The key is one unified workflow, so finance has visibility of both.

ExpenseIn manages both card spend and reimbursements in the same platform.

Look for expense tracking software that prompts employees at the point of spend, not weeks later.

With ExpenseIn, staff get a push notification to snap the receipt immediately, which is then coded and attached automatically.

Not if you choose a card provider designed for finance teams.

ExpenseIn supports roles, permissions, and entities in one platform, so each team sees only what’s relevant.

Being audit-ready means every transaction can be traced from start to finish:

The receipt is captured

The expense is coded correctly

It’s approved by the right person

And it’s posted into your accounts

With ExpenseIn, that evidence is stored digitally and exportable for auditors in seconds.

The Bottom Line: Picking the Right Expense Card in the UK

The best business expense card provider for UK finance teams isn’t simply the one with the flashiest app or lowest card fees.

It’s the one that prevents admin from landing back on your desk, keeps you compliant with HMRC and Revenue, and gives you confidence in your numbers every day.

That’s why finance leaders across the UK and Ireland are switching to ExpenseIn.

Want to see how ExpenseIn works in practice? Book a free demo and walk through the full workflow with our team.