How Can Cloud-Based Expense Management Systems Help Your Finance Department Overcome its Top Challenges?

In our previous blog post, we discussed the top challenges faced by today’s finance managers, including embracing new technology, taking responsibility for tasks outside of their traditional role, keeping on top of compliance, and more.

Image: ©AndreyPopov via canva.com

Image: ©AndreyPopov via canva.com

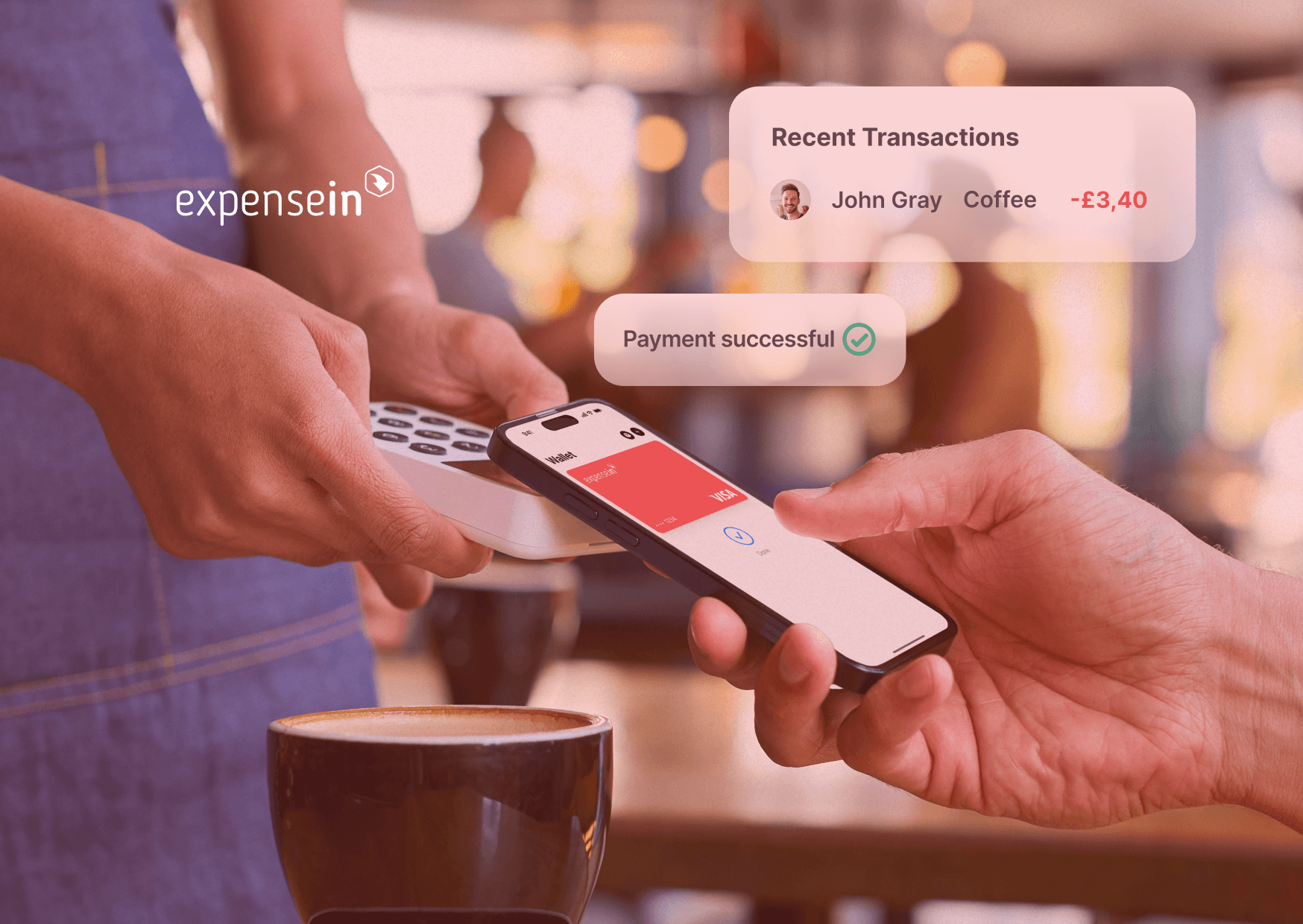

While finance managers of our current era are facing more challenges than their predecessors, they also have access to technological innovations that weren’t available previously. One of these is cloud-based expense management software, which allows finance departments to automate time-consuming tasks, ensure compliance, and access real-time data like never before.

Let’s take a closer look at how cloud-based expense management apps are helping finance departments overcome their top challenges.

1. Objectives are Being Met Faster and Easier

Remember how we mentioned that many finance managers are finding themselves working within smaller teams, and therefore having to take on more responsibilities? From training new staff to added admin processes – financial executives are struggling to find adequate time in their workday for more vital tasks.

Cloud-based expense management systems, such as ExpenseIn, reduces time-consuming admin tasks, improves efficiency, and enables finance staff to get back to more important jobs. It does so through various features, including receipt scanning, which lets ExpenseIn’s receipt team handle the data entry.

ExpenseIn is also compatible with the most popular accounting packages, including Xero, Sage, and QuickBooks. This means finance teams can export expense-related data to their accounting software with the click of a button.

Plus, with an easy-to-use interface and the ability to effortlessly record expenses on the go, finance workers can save hours training employees – as well as themselves – on how to use the new software.

2. Rules, Regulations, and Compliance are Simpler to Manage

The majority (88%) of financial workers say they find managing regulatory changes to be a challenge. Rather than work longer hours, outsource tasks, or hire extra staff to manage the additional work required to keep on top of compliance, there is a better solution.

Cloud-based expense management systems allow financial departments to increase expense guideline compliance with automatically enforced policies. ExpenseIn makes this particularly easy with multiple features, including the ability to assign and automatically enforce policies to individual users or entire departments.

To increase expense policy awareness, staff can also be required to accept policies before they start submitting expenses through the app. Plus, the days of checking receipts against every expense claim are long gone. The receipt verification process automates this process by flagging up any amount, date and VAT discrepancies. Fraudulent expenses and duplicate receipts are also detected, leaving your finance team to focus on more pressing tasks.

3. Accurate Data and Real-Time Reports are More Accessible

Along with dealing with poor data quality or inaccuracies, finance managers have also had to grapple with slow data production and the time-consuming nature of manual data ingestion. Cloud-based expense management software can dramatically assist in this arena too.

ExpenseIn allows users to access and utilise real time expense reports to make faster and smarter decisions. Finance departments can then generate data filtered by parameters such as the user, department, expense type, category and more.

Finance teams can also track costs across whole departments and individual employees and view a full audit log for each expense created and processed within the system. Plus, they can export this information into Excel to perform further data analysis with ease.