Every finance leader knows the drill.

The quarter’s nearly over, and budgets are “fine”… until the card statements hit. Suddenly, there’s a £3,000 SaaS renewal no one remembered, an unplanned ad campaign that ran longer than approved, and a pile of expenses marked urgent in your inbox.

By then, the money’s already gone, and all you can do is explain it.

It’s not that your team’s careless; it’s that your systems show you spend too late to control it. Traditional corporate cards and expense reimbursements are built for reporting, not prevention. They tell you what happened, not what’s happening.

That’s why more finance teams across the UK and Ireland are turning to virtual corporate cards. They enforce policy before the purchase, surface spend data as it happens, and make reconciliation something you review – not repair.

The Problem Finance Teams Need to Fix (and Why Virtual Cards Now Matter)

You’re finding out about spending after it’s too late to control it.

Traditional corporate credit cards and expense claims reveal what’s been spent; never what’s being spent. By the time statements land, budgets have shifted, unapproved tools have been bought, and card-not-present charges are already on the ledger.

In recent UK finance surveys, 97% of leaders said they lack real-time visibility, and 95% blamed disconnected systems for making control a catch-up exercise.

At the same time, employees are still covering business costs out of their own pockets.

In the UK, 85% of staff say they struggle with their organisation’s expense process, and more than 1 in 4 admit they’ve used a personal credit card for a business purchase.

That means employee cash flow issues, administrative overhead, and compliance risks are still alive and well.

Virtual corporate cards solve both issues by design

Control before spending happens: Apply limits, merchant or supplier rules, and expiry dates so only approved transactions go through.

Visibility as it happens: Each payment appears instantly in your expense dashboard, assigned to the right team or project, so finance can act during the month instead of after.

Reconciliation built in: Every transaction includes a digital record and receipt, removing manual matching and end-of-month clean-up.

With tighter budgets and mounting pressure to prove control, virtual expense cards give finance teams what they’ve been missing: a live view of spending and the ability to stop small leaks before they become big problems.

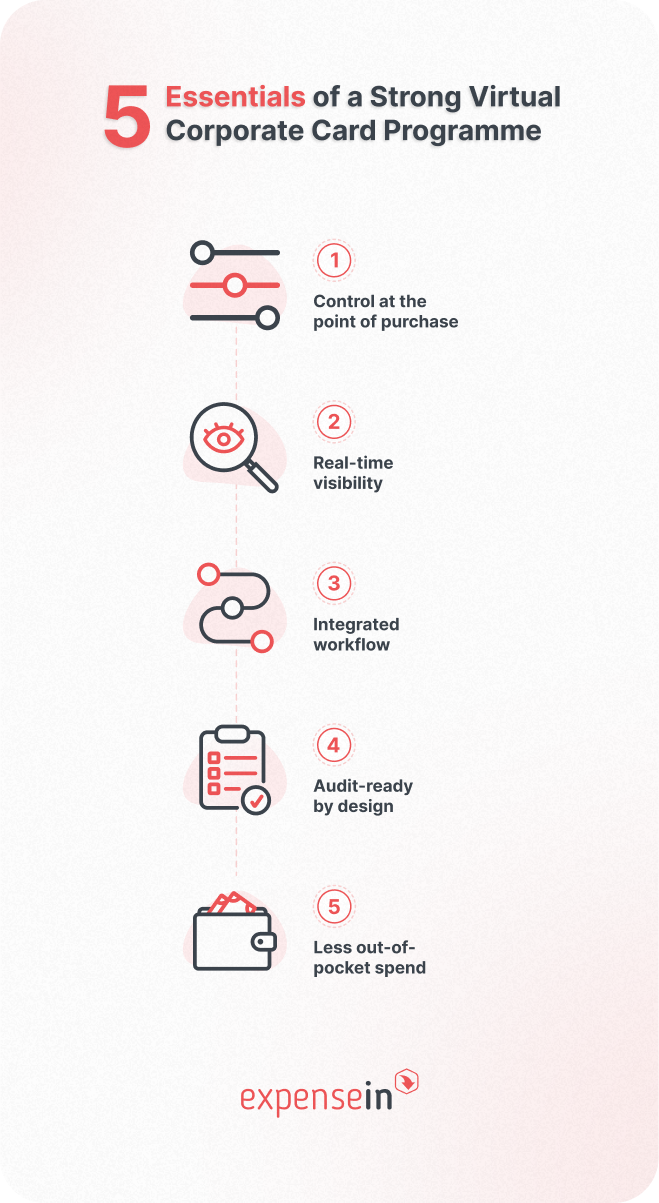

What “Good” Looks Like for Modern Finance Teams (The Non-Negotiables)

1. Control at the point of purchase

Real control starts before the transaction, not after. A strong virtual card programme lets finance:

Set per-transaction, daily, or monthly limits

Restrict spending to approved merchants or suppliers

Apply geography or time-based rules

Instantly pause or cancel cards if something looks off

For higher-risk merchants, single-use card numbers close the door on repeat charges or fraud attempts. This is policy enforcement in real time.

2. Real-time visibility across every budget

Every transaction should appear the moment it happens, tagged to the right owner, project, and cost centre.

Budget owners get notified straight away and can adjust limits or approvals without waiting for statements. That visibility gives finance the power to stop small overspends before they become big variances.

3. A fully integrated workflow (no manual uploads, no CSVs)

Your virtual corporate cards should sit inside your expense process, not beside it. That means:

Correct coding

This supports digital record-keeping and VAT compliance under UK and Irish regulations, while removing the reconciliation friction finance teams know too well.

4. Audit-ready by design

Every transaction should carry its own story:

Who spent

What they bought

Why it was approved

Proof of purchase attached

When data lives in one place, HMRC audits stop being a scramble for receipts and turn into a quick confirmation exercise.

5. Less out-of-pocket spend, fewer reimbursements

Issue virtual cards for business travel, projects, and subscriptions, so employees can pay directly within policy limits. It:

Reduces reimbursement cycles

Removes personal cash-flow strain

Ensures spend data enters the expense system at the point of purchase

Where Virtual Corporate Cards Deliver Value Fastest

1. Paid media and campaigns

Marketing spend is one of the easiest places for costs to spiral.

Assign one virtual business card per channel or campaign, ring-fence budgets, and stop “just-a-top-up” spend before it hits. Every pound spent is traceable to its campaign.

2. SaaS and recurring vendors

Subscription creep drains budgets quietly.

Issue a dedicated card for each tool or supplier with a fixed monthly cap. If pricing changes or someone forgets to cancel, the renewal is automatically declined.

3. Projects and events

Temporary projects often lead to lingering spend. Time-boxed cards that expire automatically when a project or event ends close that loop.

4. Travel expenses

Employees shouldn’t fund business trips themselves.

Virtual travel cards let them pay directly within pre-approved budgets, eliminating reimbursement delays and giving finance live visibility of travel costs as they occur.

5. Higher-risk or ad-hoc suppliers

For new or infrequent vendors, issue single-use virtual corporate cards. The card expires once the transaction clears, minimising expense fraud risk without slowing down payments.

How To Evaluate Virtual Corporate Card Providers

Choosing the right expense card provider is about who can give your finance team control, visibility, and compliance without extra admin.

Here’s what to look for:

1. Depth of spend controls

A good platform gives finance full control before money leaves the account. Look for features like:

Purpose-specific cards

Configurable spend limits

Merchant and supplier restrictions

The ability to freeze or cancel cards instantly

ExpenseIn’s virtual cards are built for this: finance can issue or pause cards in seconds, apply caps by day, project, or user, and create single-use or expiring cards for campaigns or one-off vendors.

2. Real-time visibility for budget owners

You should see spending the moment it happens.

The best systems show live transactions with owner, team, and cost-centre details, so finance can step in mid-month rather than firefighting at month-end.

ExpenseIn delivers this through real-time dashboards and mobile expense app alerts, allowing managers and finance to monitor budgets and adjust limits immediately when priorities change.

3. Integrated expense workflow (no extra tools)

Many virtual card providers stop at payments, leaving finance to patch together receipts and reconciliation later.

The right solution should integrate expense cards, policies, receipts, approvals, and integrations in one place.

ExpenseIn’s virtual corporate cards sit within its wider expense management software, so every transaction automatically prompts a receipt upload, flows through approvals, and syncs directly with your accounting software.

4. UK & Ireland-ready compliance and security

Finance teams need assurance that systems align with local regulations and data standards. Look for:

GDPR compliance

Audit-ready records

Support for HMRC-recognised digital record-keeping

ExpenseIn is headquartered in the UK, Cyber Essentials Plus certified, and built around the compliance needs of UK and Irish businesses. You get secure data handling, traceable audit trails, and controls that align with regional VAT and expense reporting rules.

5. Local support that understands finance

Implementation and ongoing support should come from people who understand finance, not just card operations.

A local support team familiar with VAT, receipts, and HMRC expectations can make all the difference.

ExpenseIn provides direct access to a UK-based support team experienced in working with finance departments. They help configure controls, fine-tune policies, and ensure integrations work smoothly with your existing systems.

Frequently Asked Questions: Virtual Corporate Cards

A virtual corporate card is a digital payment card used for business expenses, without the need for a physical card. Each card has its own 16-digit number, expiry date, and CVV, but it exists entirely online.

Finance teams can issue cards instantly for a project, campaign, or team, apply spending limits, and track every transaction in real time.

With ExpenseIn, virtual expense cards sit inside the expense management system, so spend, receipts, and approvals all flow automatically into your accounting system.

Yes, they’re more secure than physical business expense cards.

Each card number is unique and can be made single-use or set to expire automatically. If details are ever compromised, the risk is limited to that one transaction.

ExpenseIn’s virtual corporate cards can also be frozen or cancelled instantly and are backed by bank-level encryption and UK Cyber Essentials Plus certification for data protection and fraud prevention.

Virtual corporate cards remove manual reconciliation entirely.

Each purchase automatically includes a receipt prompt, policy check, and approval trail – all within the same expense management app. That means finance no longer needs to chase receipts or match credit card statements to spreadsheets.

Teams using integrated card systems like ExpenseIn typically close month-end faster, with cleaner data and fewer queries.

Employees no longer need to pay business costs from personal cards and wait for reimbursement.

Instead, they can use pre-approved virtual cards that follow company policy automatically. This removes cash-flow pressure and ensures purchases are compliant from the start.

In ExpenseIn, employees simply upload receipts via a mobile expense app, and the claim is generated instantly.

Yes, when implemented properly.

ExpenseIn’s expense tracking software supports digital record-keeping for VAT and provides a full audit trail for every transaction, meeting HMRC and Irish Revenue standards. All data is stored securely in compliance with GDPR and local data-protection laws.

ExpenseIn’s virtual cards integrate directly with your existing accounting software (including AccountsIQ, Xero, Sage, and QuickBooks) and can be rolled out in phases.

Many finance teams start with one department (like Marketing or IT) to prove the control and time savings, before scaling company-wide.

Cards can be issued in seconds and configured with the same approval workflows you already use.

Bring Spend Control Back to Where It Belongs: Inside Finance’s Hands

For UK and Irish finance teams, the gap between spend happening and spend being seen is where control is lost.

Virtual corporate cards close that gap, giving finance leaders live oversight, automated compliance, and a workflow that runs itself.

The result isn’t just fewer overspend surprises; it’s a calmer, faster, and more predictable month-end. Teams spend less time chasing receipts and more time steering budgets where they matter.

ExpenseIn brings that control into one platform – where virtual cards, expenses, approvals, and accounting integrations work together in real time.

See it for yourself. Book a demo to explore how ExpenseIn’s virtual corporate cards can help your finance team stop overspend before it happens.