Every finance team knows the routine. Month-end rolls around, and the day disappears into chasing receipts, decoding statements, and patching together spend that should’ve been visible weeks ago.

It’s a symptom of a process that’s out of step with how modern finance operates.

Across the UK, employees are quietly bankrolling their employers. More than 80% have been left out of pocket for over a month after paying for business costs themselves, and an estimated £690 million in expenses go unclaimed or unpaid each year.

For finance teams, that means lost time, constant follow-ups, and visibility gaps that make it hard to forecast accurately.

When spend is only reviewed after claims arrive, policy breaches and fraud risks (costing UK businesses over £2 billion annually) often slip through unnoticed. It’s not an admin quirk; it’s a broken model.

The old “pay first, claim later” approach pushes cash-flow pressure onto employees and leaves finance working in hindsight. It’s time for a model built around real-time control, not retroactive clean-up.

So, what’s the alternative? For many finance leaders, the answer lies in employee expense cards.

What Are Employee Expense Cards?

Employee expense cards are company-funded cards issued to individual team members for business spending. Each card (physical or virtual cards) draws from a central balance managed by finance.

You decide how each card can be used by setting:

Spending limits per employee or team

Merchant category restrictions

Approval rules that mirror your expense policy

Unlike corporate credit cards that reveal spend only when the statement arrives, expense cards give you live visibility.

Every transaction appears instantly, complete with merchant, category, and value.

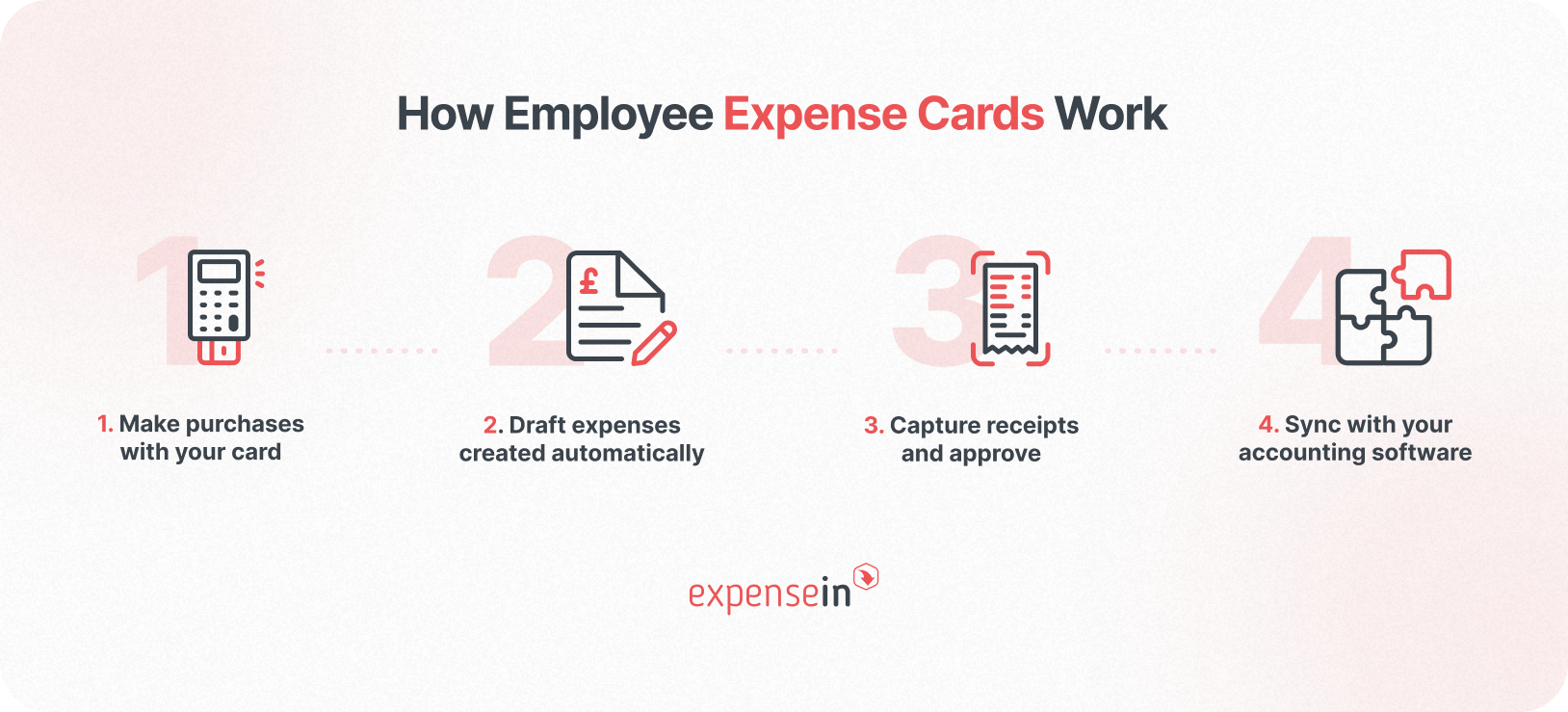

And when connected to your expense management software, the process becomes seamless.

And when connected to your expense management software, the process becomes seamless.

Each payment automatically generates a complete record:

The transaction is captured in real time

The employee receives a prompt to snap and attach the receipt

Policy checks happen automatically

In other words, the payment becomes the expense report: coded, compliant, and ready for approval without manual intervention.

How Expense Cards Eliminate Reimbursements (& The Admin That Comes with Them)

Expense reimbursements create friction at every level.

Employees cover company costs out of pocket; finance teams chase receipts and validate claims after the fact.

Expense cards remove that cycle entirely.

Employees spend directly from company funds, which means no more waiting for repayment – a change that 83% of UK employees say would ease financial pressure.

Here’s what that looks like in practice:

No more out-of-pocket costs: Staff no longer act as the company’s lenders. Business travel, client meals, or subscriptions are paid instantly from company funds.

Receipts captured immediately: Each transaction triggers a mobile prompt. The receipt is snapped and matched automatically. No chasing at month-end.

Policy enforced upfront: Daily limits, category blocks, and approval rules stop out-of-policy spending before it happens.

For finance, that means fewer manual reviews, faster closes, and reliable data.

Expenses are created, checked, and categorised automatically, freeing your team to focus on the work that actually matters.

What to Look for in an Employee Expense Card Solution

The right expense card program should do more than issue payments; it should give finance complete visibility and control.

Look for:

Look for:

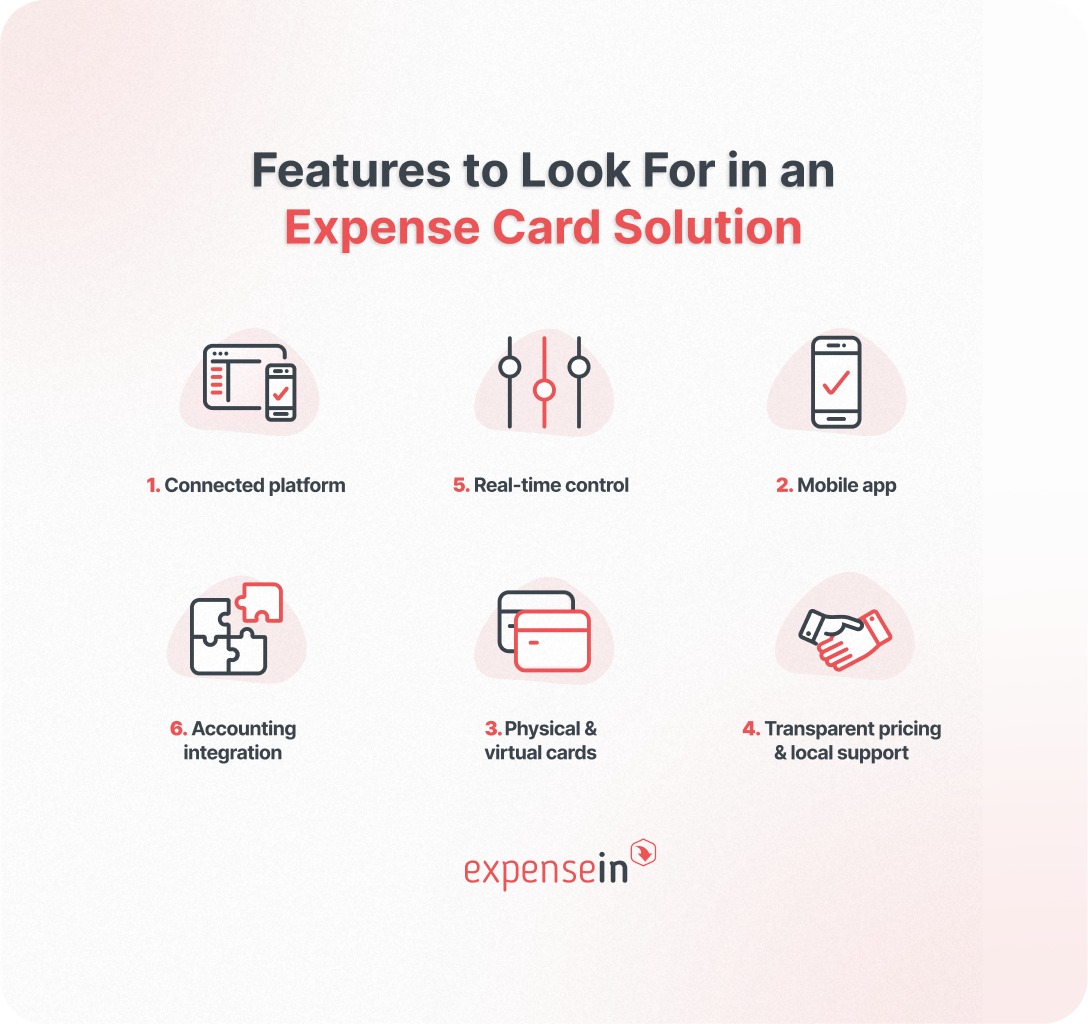

1. One connected platform

Choose a solution where spend cards, approvals, policies, and reporting all live in the same system, not a separate card portal.

2. Real-time, granular controls

Look for tools that let you set per-user limits, merchant category blocks, and per-transaction caps, with the ability to freeze or adjust cards instantly.

3. Intuitive mobile expense app

Adoption depends on usability. Make sure employees get instant spend notifications and can capture receipts in seconds via a clean, intuitive mobile expense app.

The easier it is to do the right thing, the less time finance spends chasing receipts.

4. Seamless accounting integrations

Your expense card solution should connect natively to AccountsIQ, Xero, Sage, QuickBooks, and other leading accounting systems.

Every approved transaction should flow automatically into your ledger with accurate coding and VAT treatment, cutting hours from month-end close.

5. Physical and virtual cards

Flexibility matters.

Issue virtual expense cards instantly for online purchases, software subscriptions, and remote teams, and physical expense cards for travel, meals, or in-person expenses.

Each should carry the same controls and visibility so you can retire shared corporate cards entirely.

6. Transparent pricing and local support

Avoid hidden fees and offshore helpdesks.

Choose a provider that offers fair pricing (no surprises on FX, issuance, or usage) and UK/IE-based support that understands local compliance, HMRC, and Irish Revenue requirements.

In short: Your ideal solution should unify payments, policies, and reporting so finance can manage spend proactively – not after the fact.

Why Finance Leaders Choose ExpenseIn for Expense Cards

ExpenseIn was built from the ground up for finance teams.

Its ExpenseIn Card, powered by Stripe, integrates directly into the expense management system, bringing spend control, expense capture, approvals, and accounting into one smooth workflow.

One central balance: A pre-funded account you top up, with individual cards and custom limits for each employee.

Live visibility: Update limits, block categories, or freeze cards instantly.

Receipt scanning: Staff get a mobile prompt after each purchase; receipts are attached and matched automatically.

Direct accounting integrations: Approved expenses sync straight to AccountsIQ, Xero, Sage, or QuickBooks, coded and VAT-ready.

Physical and virtual cards: Teams can pay online or in person with the same level of control and transparency.

ExpenseIn’s research shows why this matters: 28% of UK employees are chased weekly for receipts, and 10% daily.

The ExpenseIn Card ends that cycle, giving finance real-time visibility and employees a smoother, fairer experience.

FAQs About Employee Expense Cards

Not at all. Many cards on the market act as basic prepaid cards with limited control or integration, which can still leave finance working reactively.

The ExpenseIn Card is different – it’s built specifically for finance teams.

It combines real-time spend visibility, integrated approvals, and accounting sync in one platform. That means every transaction is automatically captured, coded, and ready for reconciliation.

Security varies between providers.

ExpenseIn’s business expense card includes per-user limits, merchant category controls, and instant freeze or adjust options, all managed from one dashboard.

Each card is fully traceable, and every transaction is logged in real time, giving finance complete oversight and reducing the risk of expense fraud or misuse.

Only if the provider captures the right data.

ExpenseIn's company expense card is fully compliant because it automatically stores digital receipts (or e-receipts), merchant data, and VAT-ready coding for every transaction.

This creates a complete audit trail that supports HMRC and Irish Revenue requirements for VAT reclaim and expense documentation.

Some might not, but ExpenseIn does.

ExpenseIn's employee expense card connects directly with major accounting and ERP systems.

Virtual spend cards can be issued instantly for online purchases, subscriptions, or remote teams instead of waiting for physical cards to arrive.

Each virtual card carries the same spend rules, limits, and live tracking as a physical expense card, helping finance control digital spending without relying on shared card numbers or manual reconciliation.

Take Control of Employee Expenses & Leave Reimbursements Behind

Manual reimbursements slow finance down and frustrate employees. Expense cards solve both.

By connecting company-funded cards directly to your expense tracking software, every transaction becomes a single, accurate data point: captured, receipted, and approved automatically.

Finance gains control and clarity. Employees get simplicity and fairness. Month-end becomes something you finish, not something you fight.

Book a demo today to see how ExpenseIn can help you cut admin, control company spending, and end reimbursements for good.